Blockchain & Self-Actualization

All new technologies are driven by a feedback loop between the supply side (developers/employees who are excited to work on a product) and the demand side (consumers/enterprises who want to buy the product). In today's post, I want to explore the supply side in blockchain.

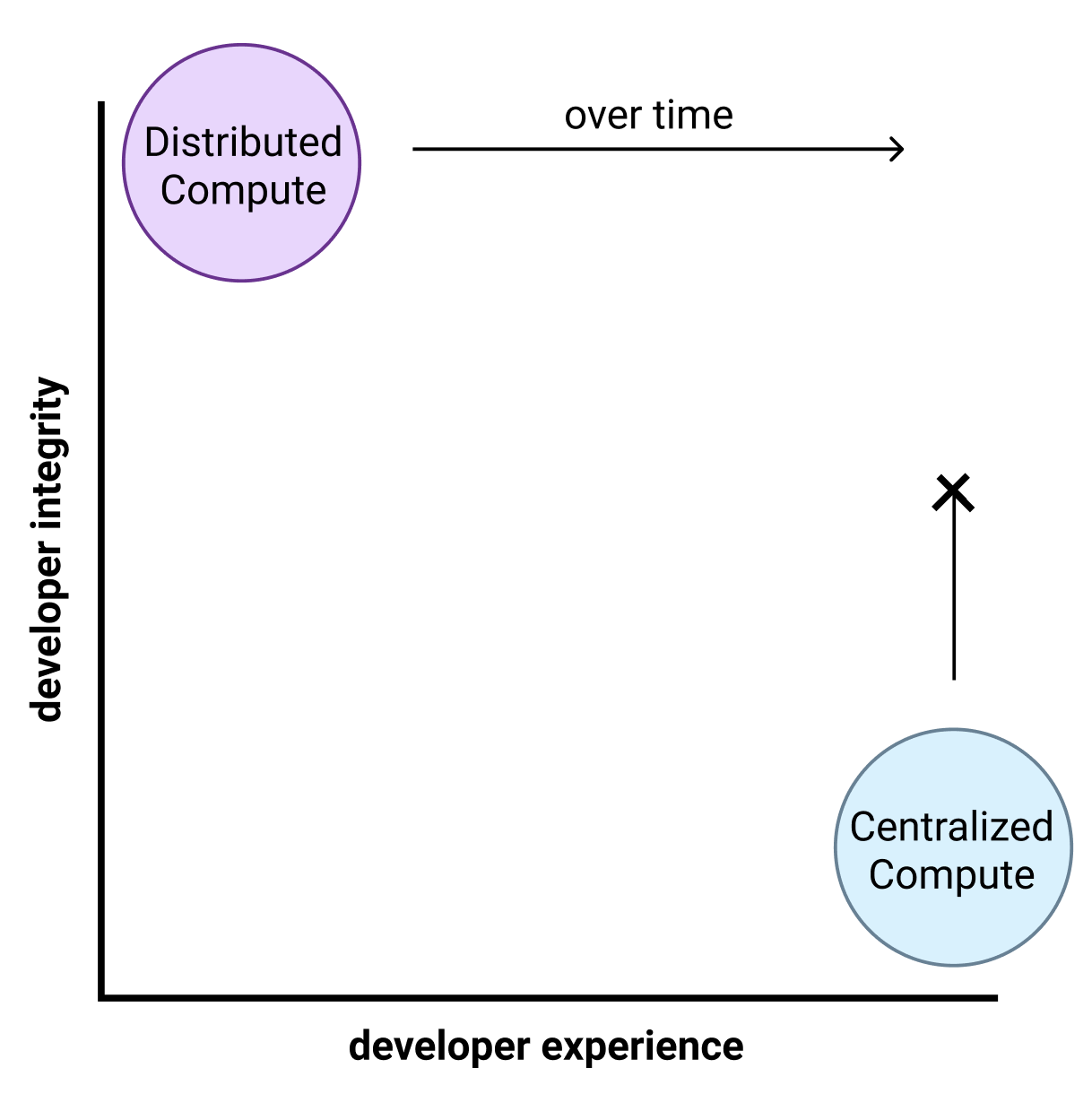

Current View: Blockchain Wins on "Developer Integrity" from "Trust as a Primitive"

The current argument is that blockchain "supply" (i.e. developers, finance folks, academics, etc.) comes from "developer integrity". Dani Grant (and Nick Grossman) from USV explain it well here:

Developers can trust that a distributed compute protocol won’t go away, fall down, lock them in, revoke their access, or become their direct competitor. Developers cannot trust Amazon, Google or Microsoft to promise them the same.

In other words, the underlying protocol has "integrity" that allows developers to build on it. Right now, the developer experience for building on these distributed protocols is worse than centralized platforms. However, we expect blockchain developer experience to get better and eventually rival centralized platforms. In contrast, centralized platforms will never be able to beat decentralized protocols on integrity (given their technical architecture). Dani summarizes all of this in the graph below:

In addition to USV, a16z seems to hold a similar mindset. In his announcement for a16z crypto, Chris Dixon makes a similar claim:

The new primitive of trust also means that 3rd-party developers, entrepreneurs, and creators can build on top of crypto-powered platforms without worrying about whether the rules of the game will change later on. In an era in which the internet is increasingly controlled by a handful of large tech incumbents, it’s more important than ever to create the right economic conditions for developers, creators, and entrepreneurs.

Both Chris and Dani are claiming that blockchain is winning over founders with "developer integrity" based on the "primitive of trust". And I agree!

Blockchain ALSO Wins on Self-Actualization

However, Dani and Chris don't explicitly call out another crucial feature of blockchain—it satisfies our need for self-actualization. This is often discussed in the crypto world. e.g. "Crypto is a philosophical movement, not just technology! Crypto is the red pill to go down the rabbit hole!". However, I'd love to more explicitly highlight it. Let's break self-actualization down into two parts: curiosity and meaning.

Curiosity

Because blockchain modifies underlying primitives (trust, money, data, contracts) across a variety of disciplines (computer science, economics, law, ethics), it acts as an intellectual honeypot for quick learners. It's like a hydra—each solved truth spawns two undiscovered questions. In other words, the idea maze itself is antifragile.

Right now our need for curiosity isn't being met. As a financial analyst, lawyer, or developer, you operate in existing paradigms, optimizing within existing problems rather than discovering new questions. Work is moderately interesting, but is constrained one abstraction layer beneath the system level. (Boring!)

So crypto steps in and says, "Hey! Do you want to explore how the global financial system works? Or how the internet protocols were designed? Or how cryptocurrencies should be regulated as an asset class? How we can build a parallel system that outcompetes (and interoperates) with the existing ones? Do you want to learn about cryptography, distributed systems, incentive mechanisms, financial derivatives, contract law, and regulatory arbitrage? Do you want to help build a new academic field?"

And then the hyper curious folks say "omg, yes plz". The crypto world is able to satisfy their constant need for learning. (A sub-need within self-actualization.)

Meaning

In addition to curiosity, blockchain satisfies our need for meaning.

Because blockchain modifies underlying primitives (trust, money, data, contracts) across a variety of disciplines (computer science, economics, law, ethics), it can provide high-leverage meaning in the face of planetary fragility and abundance. i.e. It can help us change the world (or at least tell ourselves this story).

Right now, our need for meaning isn't being met. As a financial analyst, lawyer, or developer, you can move money around on Wall St., litigate how money moves, or work on ads with Facebook/Google. (As Jeff Hammerbacher said, "The best minds of my generation are thinking about how to make people click ads.") Although these low-meaning jobs pay you lots of money, we already make enough money!

So crypto steps in and says, "Hey! Do you want to help others? Do you want to change the technical, economic, and political operating systems of humanity? Do you want to create a new kind of distributed trust that will act as a foundation for a bottom-up digital civil society? Do you want to build out protocols of the next internet? Do you want to change how money itself works? Do you want to solve planetary challenges by changing incentives, rather than by exploiting existing advertising-based incentives?

And then the do-gooders say "omg, yes plz". The crypto world is able to satisfy their constant need for meaning. (A sub-need within self-actualization.)

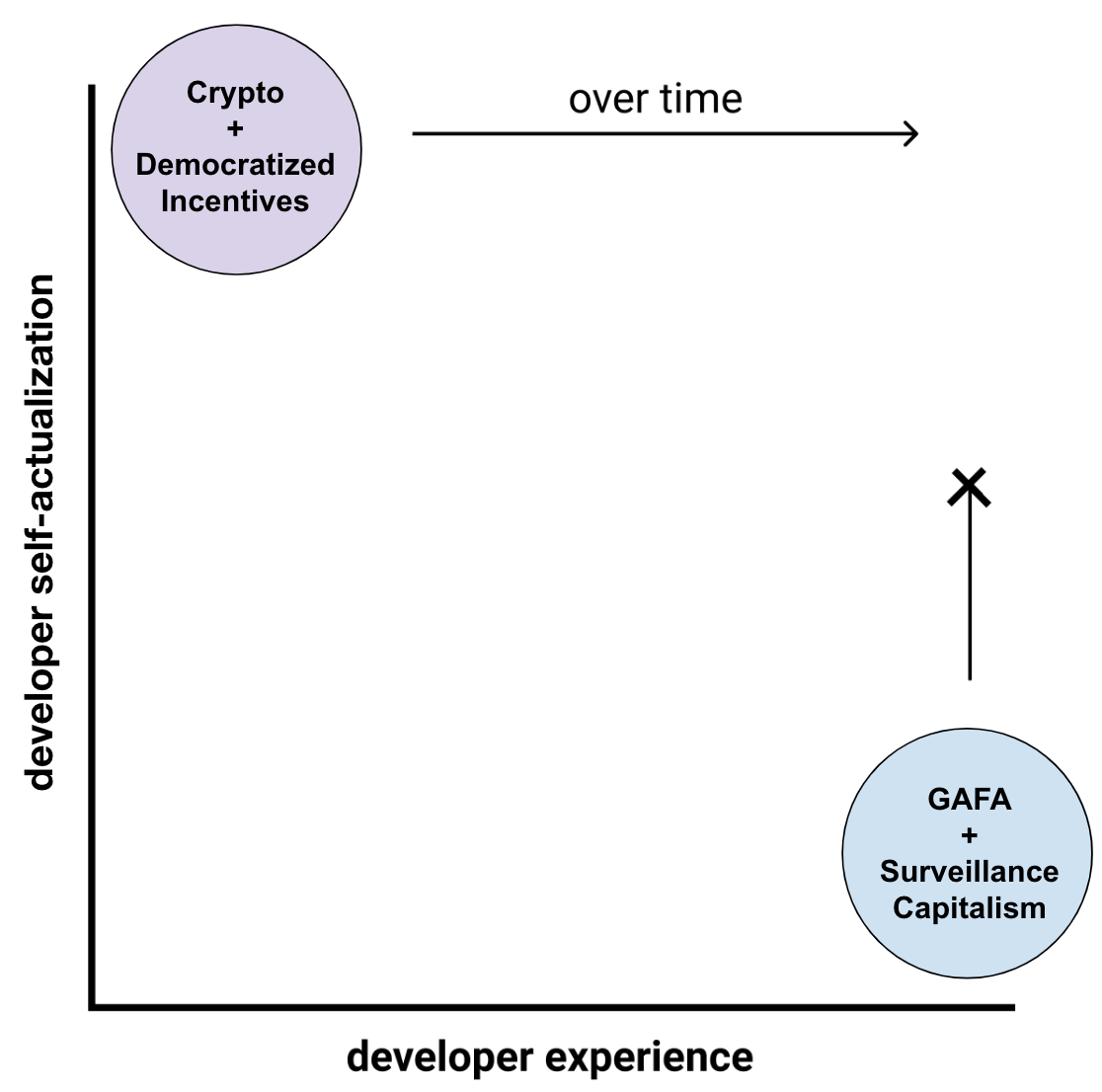

Given this, we could redraw Dani's visual to show self-actualization on the y-axis instead of integrity:

In words: GAFA used to be able to compete on their mission statements like Google's—"To organize the world’s information and make it universally accessible and useful." But the advertising business model is "capped" on self-actualization because it is destructive to society and doesn't change underlying primitives of trust/money. "Don't be evil" is less convincing than "can't be evil."

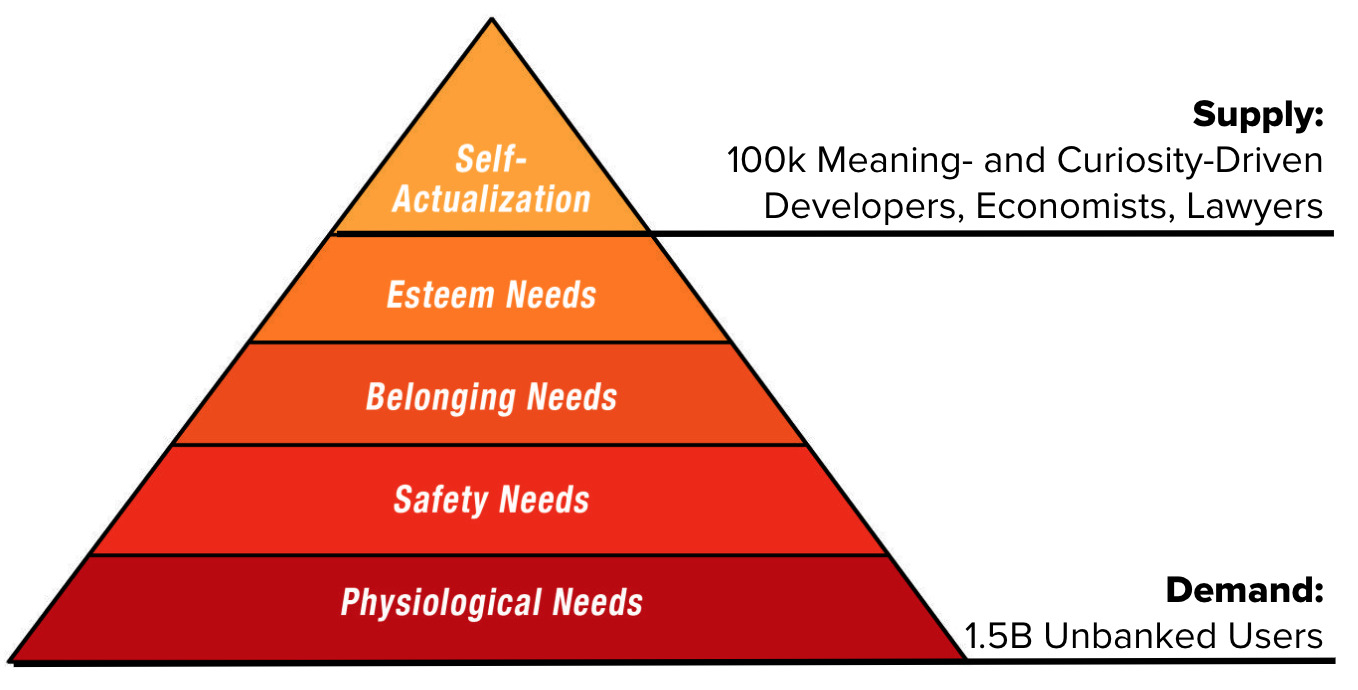

Finally, bringing this back to the demand-side (users!), we get a bimodal need-based distribution that looks like this:

In words: Blockchain supply comes from 100k self-actualization- and integrity-driven creators, while blockchain demand comes from the 1.5B unbanked adults (in addition to demand from things like regulatory arbitrage).

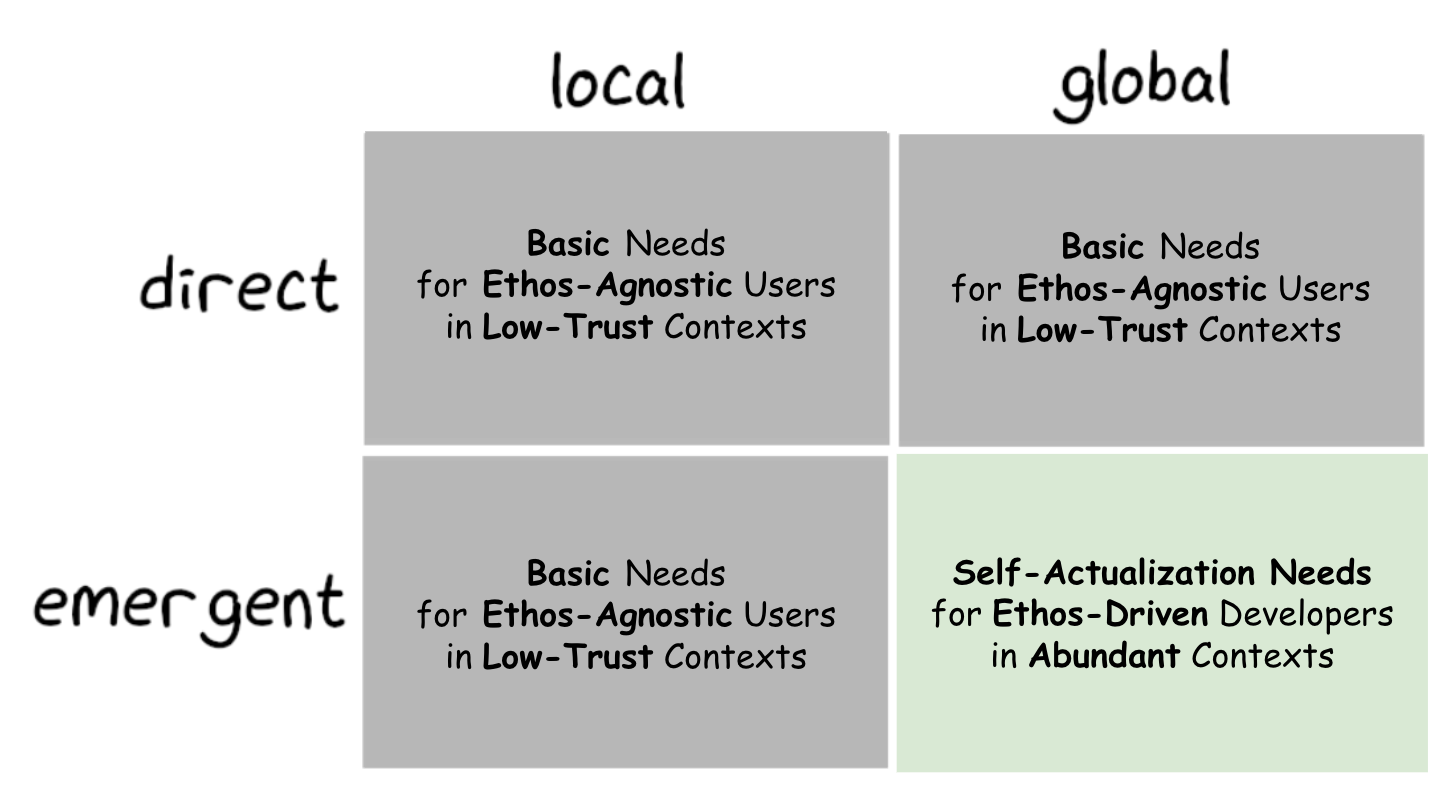

Or, to put this in the language/visuals of Nathan Wilcox, Jon Choi, and Tony Sheng: crypto provides the self-actualization needs of ethos-driven developers in abundant contexts by creating positive outcomes at the global emergent level. In contrast, crypto provides the basic needs of ethos-agnostic users in low-trust contexts by creating positive outcomes at the local direct level.

To conclude, my primary point is: In addition to developer integrity, we should add self-actualization, meaning, and curiosity to the supply-side advantages of blockchain.

Additional Thoughts:

- Of course, the 2D graph above should actually look like some n-dimensional space (including self-actualization, integrity, developer experience, etc.) where developers++ are path-finding given their specific need-based optimization function.

- We often talk about Product-Market Fit and Founder-Market fit. I'm proposing some kind of variant: Human-Needs Fit, Human-Meaning Fit, Human-Curiosity Fit, Human-Self-Actualization Fit (ugh). See Paradigm-Nature Fit.

- You can think of the curiosity point as a variant on Kuhn's process for building a new academic field. To create a new field, Kuhn claims you need to provide lots of unexplored questions. Academics then have a strong internal incentive (curiosity) and external incentive (writing papers) to pursue that new field.

- This is a "mindset" variant on William Gibson's classic quote: "The future already here, it's just not evenly distributed." But instead of referencing tech, we're referencing the mindset of individuals. e.g. You could call blockchain devs "meaning-driven developers". (Folks that have a unique future mindset that is high up Maslow's hierarchy.)

- You can think of this as a organization-level transition from Green to Teal. In Green, strong company missions used to instill a sense of purpose in employees (and made them feel like family!). Now in Teal, we have a protocol-level purpose as part of our role in The Human Organism.

- You can think of this as a version of Alex Danco's Emergent Layer Theory. i.e. We are currently overserved by GAFA perks, purpose, and massive salaries. They're trying to solve our JTBD of "happiness". But in fact we have a higher level JTBD—"meaning/self-actualization". Crypto solves this JTBD by abstracting trust/programmatic money and democratizing incentive/institution building. (Aside: on the demand side, crypto also abstracts capital itself to make it abundant, enabling more folks to move up the hierarchy of needs.)

- Another way to think of this is as the ultimate "prosumer" application: one where we focus more on the supply/developer than the demand/consumer. Like a Kickstarter/Patreon/Stripe/GitHub/AngelList on steroids. For more, see this pyramid that maps tech startups to Maslow's Hierarchy of Needs.

- For more on need frameworks, see Categorizing Needs.

Want me to write about something? Folks have been voting on my future articles here!

Update: Denis from a16z wrote about this here.