More Startups Should Use Credit Unions

Update: Lol, we ended up switching from a Credit Union to Mercury.

I just finished signing up for a bank account for my nonprofit, Roote, and wanted to share my thought process.

In the end I chose to use my local credit union, Self-Help Credit Union (SHCU), but I was very close to choosing Mercury or SVB. This was a choice between two sets of values.

On one side, I love technology and want to bank with people who understand and support technology. I want to use the best new technology and ultimately think new tech is the ultimate driver of lasting GDP growth. This makes me want to use someone like Mercury or SVB.

On the other side, I think compounding returns on capital is one of the worst feedback loops of human society. Capital begets capital and power begets power. I want to support something that is focused on democratizing economic opportunity for those without money or power. I want to use structures more similar to nonprofit member-owned cooperatives instead of tech unicorns. This makes me want to use a credit union.

Let's look in more detail at each.

I. Why You Should Use Tech-Friendly Banks

First off, it's so tempting to use Mercury or SVB.

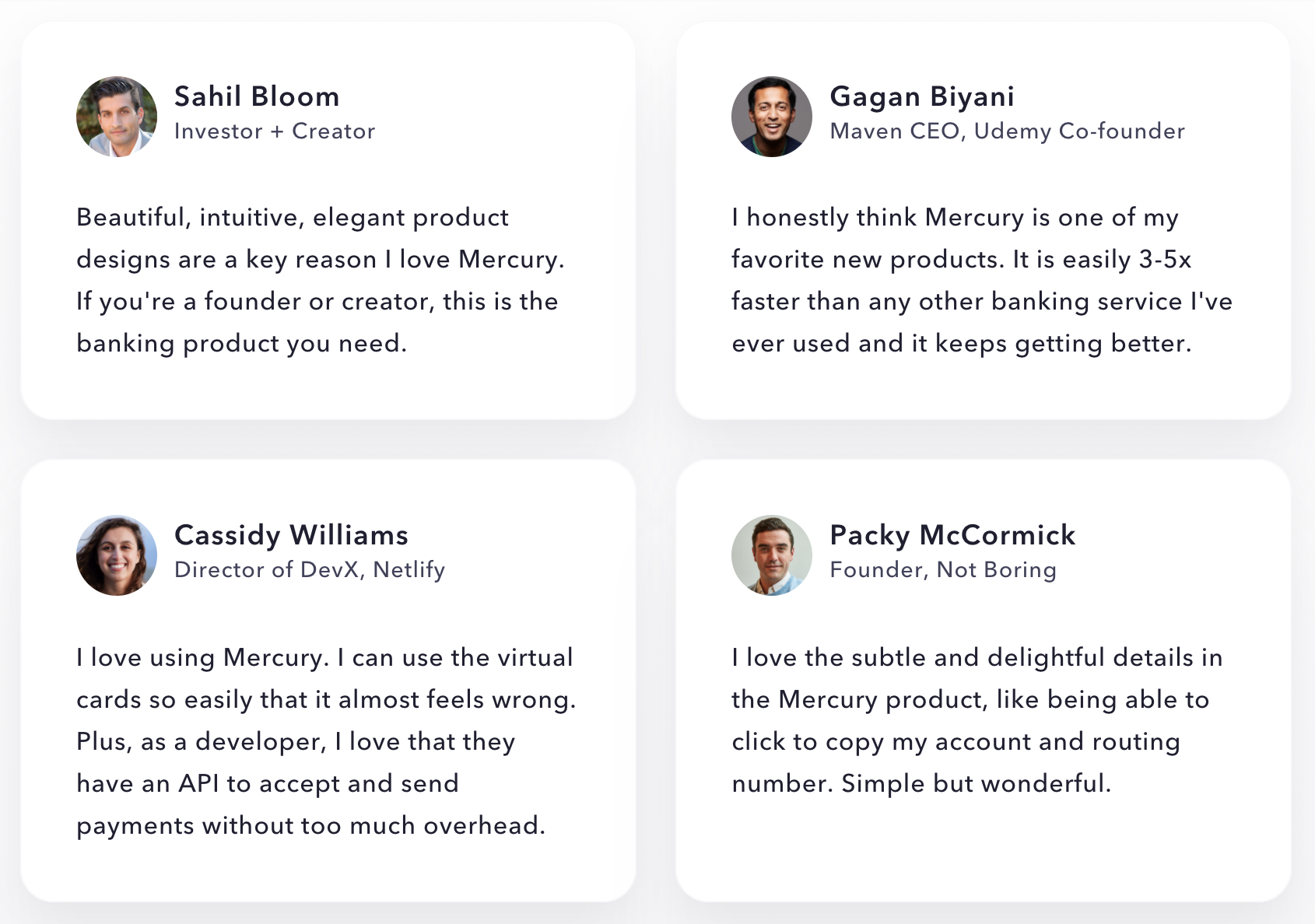

Mercury has an incredibly clean website. They're used by friends and ambitious role models.

When Jason Crawford asked what bank he should use, everyone recommended Mercury.

Seems @BankMercury is the consensus answer!

— Jason Crawford (@jasoncrawford) May 11, 2021

They have amazing reviews.

I've been using https://t.co/VBwh5B9lAM for Pinery Labs, and I've been very happy with them. Clean, modern interface with lots of easily accessible data. You can even generate "virtual cards" for various uses / people in seconds. Exceptional customer service.

— Andrew Miner (@andrewminer) May 11, 2021

Plus, I love how they have API integrations. Amazing.

And they just raised a $120M Series B at a $1.6B valuation from a16z et al.

Mercury should only get better over time.

SVB also has great brand. Many of my crypto friends recommended them for their crypto-friendly nature. Plus, so many startups use them:

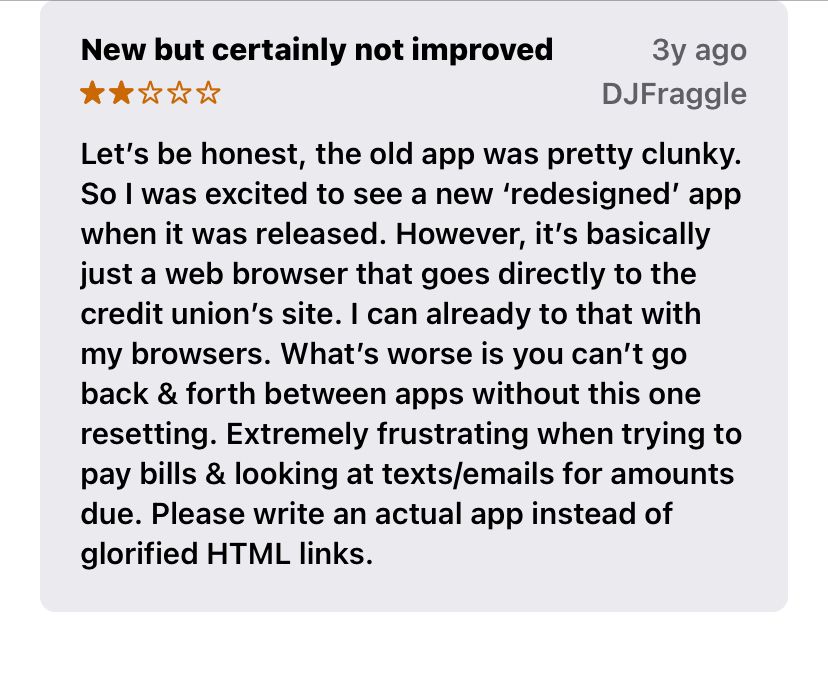

Meanwhile, the app for my credit union opened with the following review:

Woof.

So this is the bull case on using Mercury or SVB. Why not use a hip new tech startup that has a great team, great funding, and great UX? I want to support tech-first banks. Feels like a no-brainer.

Especially from a techno-optimist lens, this is what progress looks like:

- There are existing incumbents with stagnant progress (existing banks)

- But new innovative technology can break their hold and spread better experiences into the market

- Innovation increases the size of the pie. Eventually, that tech will "trickle down", just as Uber has (or older examples like the printing press or electricity).

It's temping to "vote with my dollar" towards tech like Mercury or SVB, especially because they have a great customer experience.

II. Why You Should Use A Credit Union

On the other side, credit unions seem to have more of my values at heart. Here's their mission at the bottom of my receipt after depositing my first check:

I dig that!

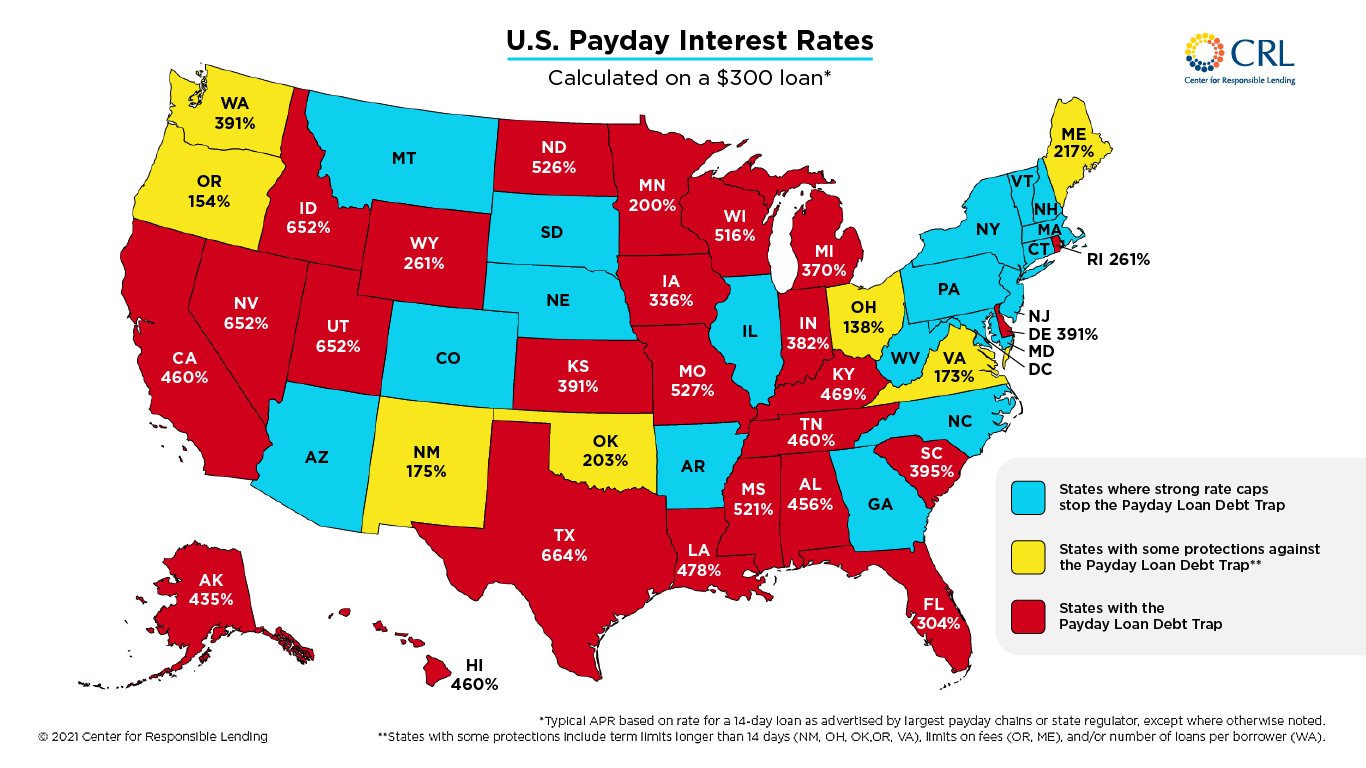

As another example, when I got my welcome packet from my credit union, they told me about their work with the Center for Responsible Lending (CRL) which advocates for less predatory lending policies. My banker told me about CRL's work spearheading the Veterans and Consumers Fair Credit Act, which caps payday loans at 36% (compared to the current caps below):

This seems great, and is truly sticking up for the powerless who haven't been on the receiving end of compounding returns on capital. (Instead they're stuck on the other side in a Debt Trap.)

Plus, my credit union is a Community Development Financial Institution, which helps support loans, home/equity ownership, and other financial help for underserved folks. And credit unions are a nonprofit, member-owned financial cooperative. If you're into coops (I am!), then you should be into credit unions. It really feels like they're helping create the Ownership Economy.

Still, a tech bank like Mercury has some aspects of distributed ownership. They offered $5M of their $120M round (4%) to investors through a crowdfund:

Excited to lead the crowdfunding portion of Mercury’s Series B.

— Sahil (@shl) July 29, 2021

Props and thank you to @immad and co for allowing us all to join in! https://t.co/VNjEP5M0YP

SVB is less clear. For example, the main page of SVB tried to sell me on their recent fine wines report.

Meh.

Still, SVB's "living our values" page is sweet. They've taken Pledge 1% (which I love) and their Community Development Finance team has "committed $750M in investments and $1.3B in loans to help build 10,000 affordable-housing units in the past two decades." That's honestly great!

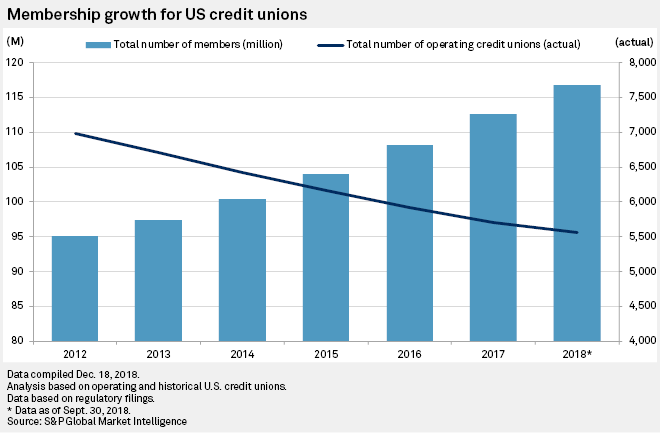

And credit unions aren't all perfect. The Internet Archive tried to create a credit union, but it was stymied by federal regulators over Bitcoin transactions and eventually shut down. Although the number of credit union members has gone up in the past decade, the total number of unions has decreased, possibly signaling over-regulation and a lack of innovation.

(Sure seems like a lack of innovation based on my credit union mobile app.)

III. Conclusion

So I'm not sure which is best. The tech banks seem awesome. They network you with ambitious folks and truly "get" the tech vibes. But credit unions are also awesome. They help democratize economic opportunity and have a beautiful member-owned coop model aligned with the Ownership Economy.

Honestly, I think they're both good choices.

The reason I went with a credit union is because I feel like it's less explored. Almost all my tech friends recommended SVB or Mercury. I don't know of any tech folks who use credit unions, even if they say they're into crypto-style distributed ownership. I want to try credit unions and try to get other folks to use them.

Plus, my experience at the credit union itself was great. Amazing Oakland community vibes, great customer service, down-to-earth people. 10/10 would recommend.

Thanks for reading and please let me know if you have thoughts either way on this post!

Notes

Two quick notes:

- Credit Unions are ripe for an open-source mobile app. They have a federated system for ATMs where all credit unions can use each other's ATMs. They should have a similar thing for their mobile apps. Develop an open-source app that all credit unions can use. Lmk if you're working on this or would like to support this work!

- Also feels ripe for a re-examination of a crypto credit union. Not sure exactly how this would work, but the values alignment is way too strong for there not to be more momentum here.