The End of Aggregation Theory

The goal of this article is to help people to understand the disruptive impact of blockchains (through the lens of Aggregation Theory). It is the first in a series of articles on blockchain macro trends (see full list at the bottom). I would love your brutal/honest feedback—the goal is to learn and actually provide value—please reach out!

The Hook: Ben Thompson (one of the best tech analysts of the 2010s) believes that blockchains could break Aggregation Theory (his defining framework to understand and predict tech trends). In Ben’s words:

This [the new incentive structure enabled by blockchain-based token scarcity] is ahuge deal, and probably the most viable way out from the antitrust trap created by Aggregation Theory.

Status Quo: FANG Aggregation Theory → ML

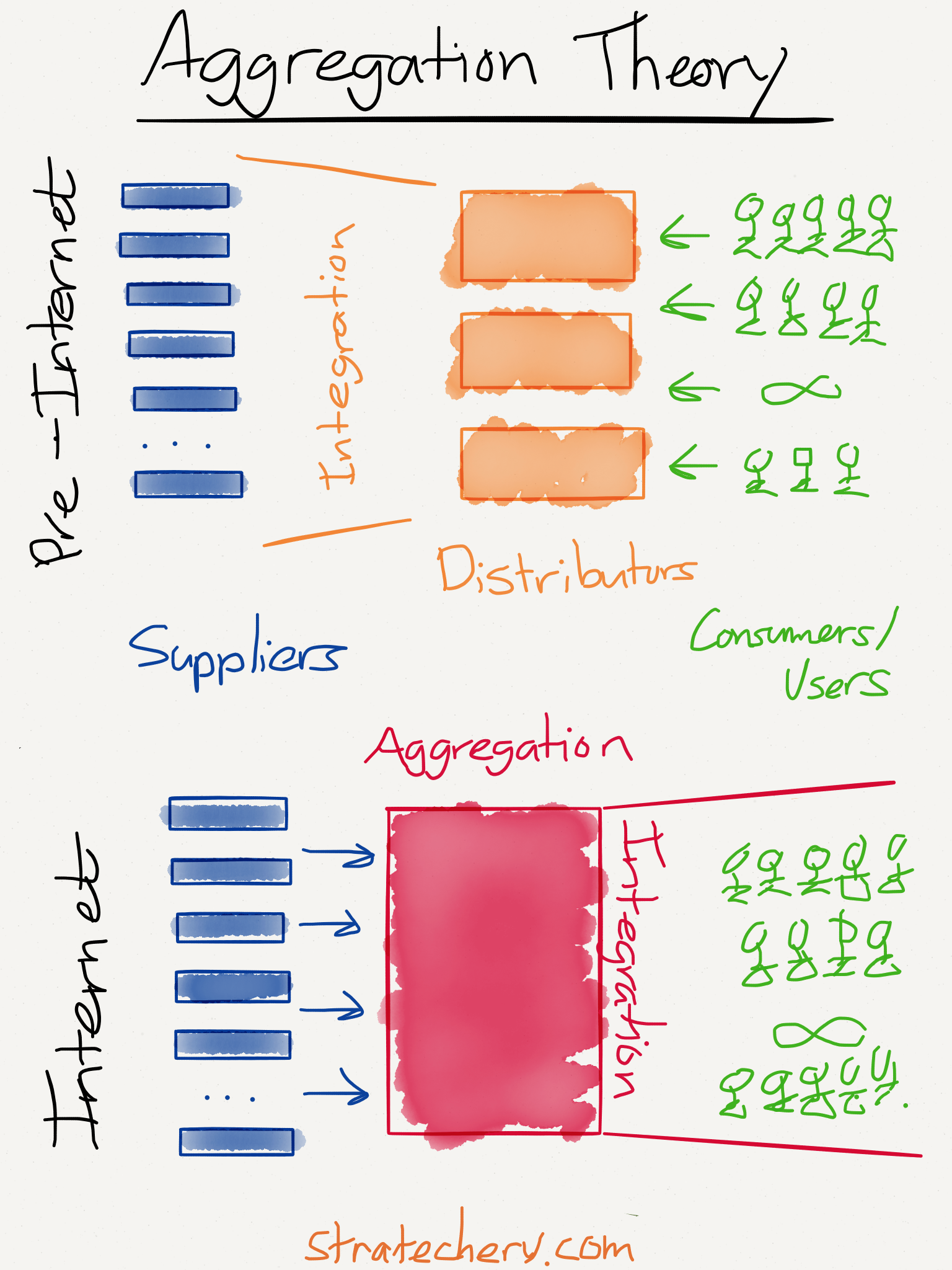

Let’s start with the 2017 status quo: Ben Thompson’s Aggregation Theory, the defining framework for understanding FANG. Ben explains it best:

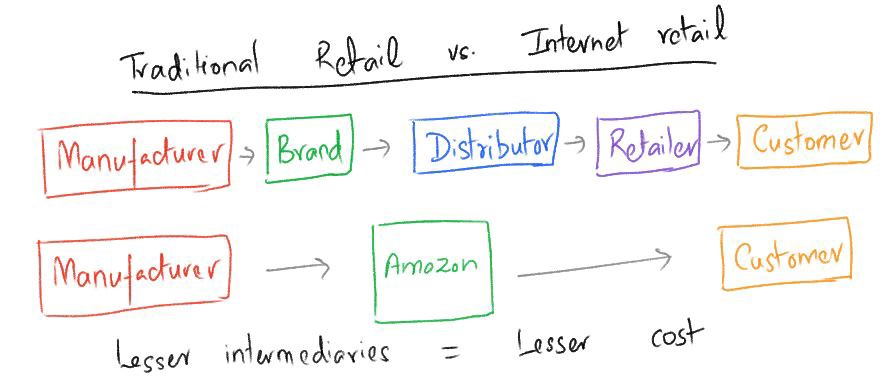

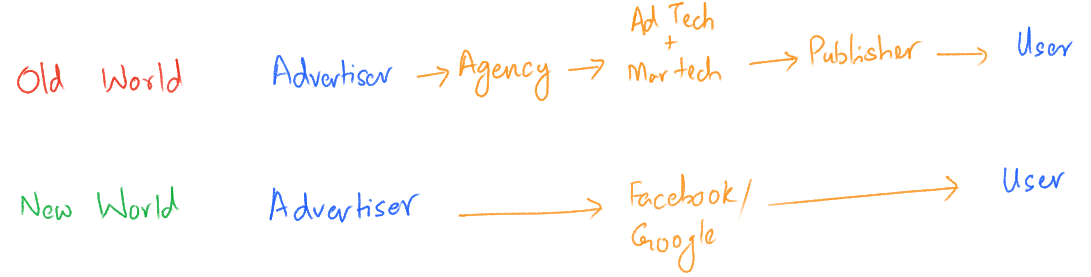

First, the Internet has made distribution (of digital goods) free, neutralizing the advantage that pre-Internet distributors leveraged to integrate with suppliers. Secondly, the Internet has made transaction costs zero, making it viable for a distributor to integrate forward with end users/consumers at scale.

In other words: tech companies aggregate demand to disintermediate the distributors (which is now possible because of zero-cost distribution) and win on a direct UX alone.

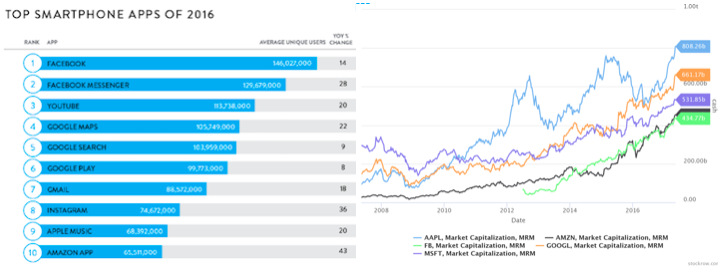

Once a company (like Facebook) starts to win, it wins big. This has created some tech giants (Uber/AirBnB + Facebook, Amazon, Netflix, Google [FANG]) that monopolize on a “tough to regulate” UX/network effect vector (1, 2). And their influence is massive. As Chris Dixon writes:

These massive companies addict users through Hooked loops to control the vast majority of digital user attention, monetize that attention through advertising, acquire companies that compete for attention (Youtube, WhatsApp, Instagram), and copy those who remain (Snapchat/Instagram stories).

And, looking towards 2020, these companies control incredible amounts of user data which situates them perfectly for AI/ML, adding systems of intelligence to their network effect/UX moat. As Rob May asks in the Inside AI newsletter — “is A.I. the sport of kings or will startups be able to compete?”

From the Exit, Voice, and Loyalty perspective, it’s difficult for startups to exercise “voice” and consumers don’t have a great “exit” option.

In the coming decade, there is an answer. Blockchains are our globalized, distributed, decentralized exit. New Googles are now possible, if still frighteningly ambitious.

A Blockchain Future: Early Adopter Incentives and Open Data

Why do blockchains allow new startups to compete with FANG and break Aggregation Theory → ML? Because blockchains diminish the two aspects of defensibility held by FANG:

- UX/Network Effects—Blockchains allow for a new monetary incentive structure which gives early adopters greater upside the earlier they join the bootstrap (which can overcome aggregators’ existing network effect).

- ML Data Advantage — Blockchains allow for a DLT (distributed ledger technology) architecture where data is shared and open, rather than a client-server architecture where data is closed and siloed.

Diminishing UX/Network Effects: New Token-Based Incentivizes for Early Adopters

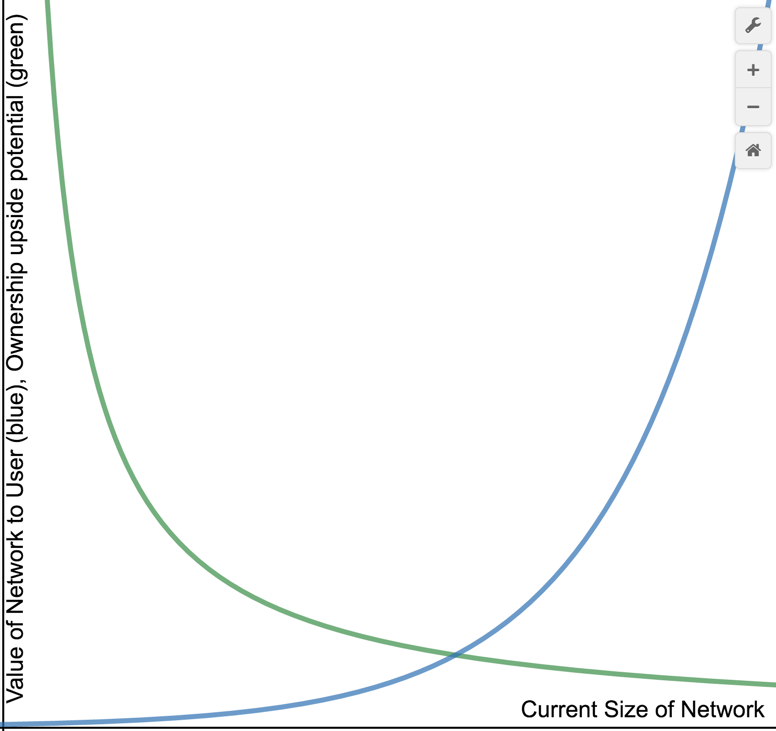

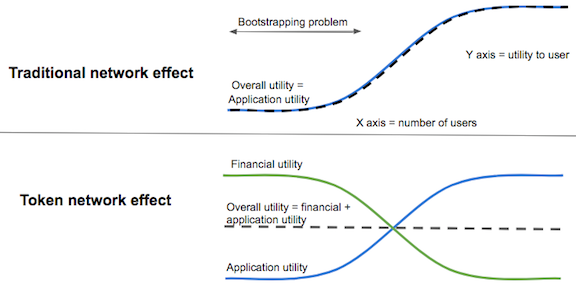

Before blockchains and the digital scarcity of tokens, it was difficult to attract early users to a new network. But now, a company can “pay” early adopters in a native token and those early adopters will be incentivized to increase the value of their tokens. I personally love Fred Ehrsam’s description and visualfor this:

So how do you get people to join a brand new network? You give people partial ownership of the network. Just like equity in a startup, it is more valuable to join the network early because you get more ownership. Decentralized applications do this by paying their contributors in their token. And there is potential for that token (partial ownership of the network) to be worth more in the future. This is equivalent to being a miner in the early days of Bitcoin. …When the network is less populated and useful you now have a stronger incentive to join it.

Or, here’s Chris Dixon’s comparison graph of the same concept:

This new incentive structure is revolutionary.

To really emphasize the point, here’s an example from the perspective of a startup founder. Let’s say you’re trying to build a community/network and are searching for early adopters. You really want to find early adopters who are already searching for existing alternatives (i.e. have high importance and low satisfaction on their job-to-be-done). And, ah ha, you’ve found one—an perfectly aligned early adopter: they share your vision, have a high importance JTBD, are dissatisfied with existing alternatives, and are ready to provide lots of feedback on your MVP.

But how should they compensate you? And, vice versa, how should you compensate them? The “value for value” exchange isn’t necessarily clear. You could charge them $10 per month for your promise/MVP, which makes sensebecause you want to make sure they actually need your product, you want to create buy-in, and you’re solving a big problem in their life. But…maybe you should actually pay them $10 per month because they are giving you so much valuable feedback and are actively making the experience great for other users in your initial community. Another way to put this: what’s the difference between a great early adopter that pays you $10 a month and a great early customer success hire that you pay $50,000 a year? They are both using your platform, providing feedback, and providing other users value. Why such a difference in monetary compensation? Only because, before blockchains, there was no way to easily compensate/incentivize early adopters for their value.

A blockchain allows you to both charge and compensate your early adopters through tokens. Your early adopter community moderators are essentially your first customer success employees. Your early adopter developers who submit pull requests and complete bug bounties are essentially your first developer employees. Instead of incentivizing Dropbox users to refer a friend by offering them storage space (Dropbox’s “native token”, which can’t be translated back into USD), you can incentivize them with FileCoin (that can be exchanged for both storage space and USD).

With blockchain, we can begin to make this equation true:

Early Adopters = Early Employees

Diminishing ML Data Advantage: A New Way to Store and Share Data

Above, we showed how blockchain-enabled token scarcity can create powerful monetary incentive structures for early adopters (and that these incentives diminish the UX/network effect moat of FANG Aggregation Theory). In addition, blockchains allow for a DLT architecture where data is shared and open, rather than a client-server architecture where data is closed and siloed. It’s an infrastructure-level solve for OpenAI’s mission. Again, from Fred Ehrsam:

And while many of the tech giants working on AI like Google and Facebook have open sourced some of their algorithms, they hold back most of their data. In contrast, blockchains represent and even incent open data. While some blockchain-based data will be encrypted and private, much of it will also be open out of necessity.

…This open data has the potential to commoditize the data silos most tech companies like Google, Facebook, Uber, LinkedIn, and Amazon are built on and extract rent from. This is great for society: it incentivizes the creation of a more open and connected world. And it creates an open data layer for AIs to train on.

This “open data for ML training” movement is already starting to happen. At Consensus 2017, Toyota unveiled its plans to make self-driving car data open (rather than Google’s, Uber’s, etc., which is closed). This open data movement is also happening at the individual level, with “self-sovereign identity” dApps like Token. With self-sovereign identity, you (not FANG) control and get paid for access to your data/attention (see AttentionEconomy system-level diagrams: 1, 2).

This new way of storing data in the open will allow new companies to compete with FANG in the next stage of AI/ML automation.

Conclusion

It looks as if Aggregation Theory → ML might be diminished by leveraging two aspects of blockchains: early adopter incentives and open data. The one final way to think about this is in a “classic” blockchain sense: disintermediate rent-seeking middlemen through smart contracts. As Rohan Rajiv writes:

Aggregation Theory is the shift from many distributors/middlemen to one.

Blockchains enable the shift from one aggregator to none.

Open Questions

- What am I wrong about/missing?

- How should FANG address blockchain?

- What are the defensible moats in the age of early adopter monetary incentives and open data?

Thanks to Ben Thompson, Chris Dixon, Fred Ehrsam, and everyone else who makes their ideas open. Also, thanks to ConsenSys and CoinDesk for giving me free “press passes for social good” to Ethereal and Consensus 2017 (and to William/Nick for organizing Token Summit, even though I didn’t ask for a press pass :).

About Me: My name is Rhys Lindmark and I’m creating a humanist blockchain future by writing, speaking, advising blockchain/social good companies, and connecting people. I’m part of the Blockchain for Social Impact Coalition and an active member of Effective Altruist, Futurist, and UBI communities. I live in Denver, CO and I’m an alumnus of Techstars Boulder 2015. Please reach out if you’d like to connect or have feedback! I’m curious about what you’re working on. You can support me on Patreon, follow me on Twitter, or connect on LinkedIn.

Disclaimer: I own less than $100 of any given cryptocurrency, so my monetary incentive is not directly aligned with Bitcoin, Ethereum, etc. Over time, we may be able to create LongTermCoin and I would align my incentives with that.

Future Articles

Macro Trends/Venture Capital

- Hyper Network Effects: An Age of Jerk not Acceleration

- Blockchain + Alex Danco’s Abstraction of Trust

- FaaS, Serverless, and Paid API Keys

- Digital Scarcity

- Incentivized, Decentralized Machine Learning for X (numer.ai, TrueBit, 538)

- Monopolies, Category Kings and the New Moat: Zero to One + Play Bigger

- Community as Entity—Should YC Accept a Reddit Community Into Their Next Batch?

- The Disintermediation and Liquidation of Venture Capital: Techstars Anywhere, YC’s Startup School, and Integration with Classic Education

- Smart Contracts Define The Self: Fiverr, Colony.io, and the New Gig Economy

New Protocols

- Incentivizing New Language: Esperanto, Constructed Language, Universal Language of Visual Thought, Neuralink, and AI Communication

- Incentivizing Crowd Sourced Design

Attention Economy

- New Google/Facebook: The Attention Economy and Meta Scaffold

- Attention as the Killer “Meta dApp” for Time: The Convergence of Education, Boredom, and the World After Capital

- Min and Max Diff Communication: Incentives for Talking with the Other Side

- Blockchain TimeWellSpent: Meta Annotation, the Transparency of Influence and Hooked, and the Morality of Variable Reward

- EveryNoiseAtOnce and a Visualization of Blockchain Learning

Blockchain for Social Good

- An Intro to CryptoUBI

- Convergence of Creative Destruction Externalities: Industrial Revolution → Climate Change, Automation → Blue-Collar Job Loss, Blockchain → White-Collar Job Loss

- Effective Altruism on the Blockchain

- uPort’s Moral Persona

- John Rawls’ Original Position is Now Trackable on the Blockchain

- Mass Audience Blockchain Fiction that Isn’t Cryptonomicon

- Blockchain-Based Government Solves the JTBD of Bernie Supporters, Trump Supporters, and Those Who #Resist

- Blockchain-Based Urban Planning: CommunityCoin, Neighborhood Associations, NIMBY-ism

- The Blockchain User Profile: Divesting and Quantifying Your Incentives

Cross-Application of Books

- Taleb + Blockchain: Asymmetry, Antifragility, and Skin in the Game

- 12 Inevitable Forces + Blockchain

- Communication as Reputation: NVC, 5 Dysfunctions of a Team, DDOs, and the 5 Love Languages

- Thinking in Systems + Blockchain

Lean + Help for Blockchain Founders

- The New Lean Canvas for Blockchain

- Growth Hacking on Blockchain

Other

- Blockchain as a Drug and a New Kind of Distributed Vertigo

- Blockchain as a Music Genre: Vaporwave, UjoMusic, and Remixing

- Controversies in Blockchain