CryptoBoomer's Guide To DeFi 2.0

Web3 from 2017 to 2021

I saw this tweet from my friend Jill the other day:

I am going to have to spend time understanding Olympus now aren't I

— Jill Gunter (@jillrgunter) October 11, 2021

I knew nothing about Olympus (or the DeFi 2.0 movement). But, 15 hours later, here's an update on DeFi 2.0 and the crypto ecosystem more generally.

The goal of this piece is to put DeFi 2.0 in the context of Web3 more generally from 2017 to 2021.

We'll spend sections I, II, and III on context, and then dive into DeFi 2.0:

I. Where Are We Now?

II. NFTs, DAOs, and DeFi Are A Feedback Loop

III. Crypto Is A "Nuclear Reactor" For Money and Memes

IV. What's Going On In DeFi 2.0?

V. Other Trends

Let's dive in!

I. Where Are We Now?

Every new bull phase in crypto makes the last bull phase look extremely weak.

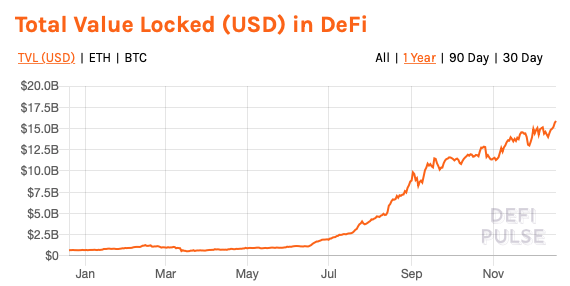

Remember when everyone was talking about DeFi Summer in 2020? Liquidity mining was all the rage. Over $10B locked in DeFi. Wow! The graph below shows DeFi from Jan - Nov 2020:

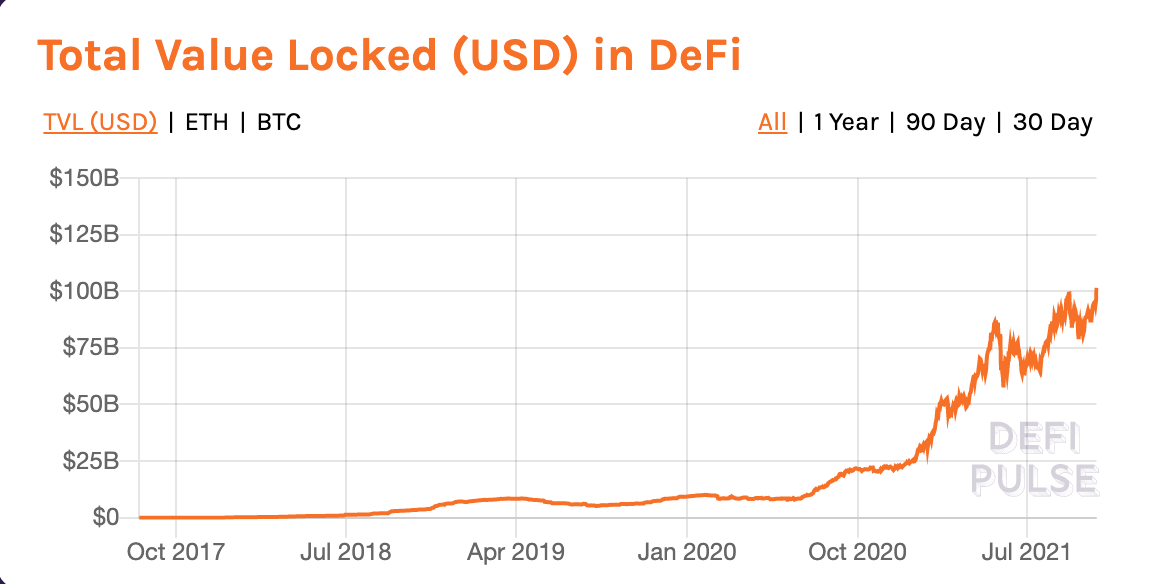

But now we're over $100B locked in DeFi, a 10x increase. It's hard to even see so-called DeFi Summer on the graph.

Similarly, I remember the good ol' days of the ICO boom of 2017 and 2018, when projects were raising tens of millions of dollars, then hundreds of millions of dollars, then billions of dollars (looking at you, EOS).

Earlier this year, Fei Protocol raised $1.2B, but the mainstream heard nothing of it.

Looking at the top coins by market cap, things have gotten a lot better since 2017. Here's the top 20 then. Not great.

There are three four projects and the rest vary from honest attempts to straight up scams (BitConnect).

Here's where we are now in 2021:

tbh, it's not perfect. A surprising amount of meme forks and ~scams still there. But a lot more real stuff.

And while the long tail in 2017 was even worse than the top 20 (if you believe it), the long tail now is quite good:

#21 Polygon, #22 Cosmos, #25 Dfinity, #26 Axie, #27 Filecoin, #29 FTX, #35 Tezos, #40 Elrond, #42 PancakeSwap, #44 Flow, #45 Near, #46 Aave, #47 The Graph, #60 Olympus, #61 Arweave, #66 Stacks, #68 Maker, #71 Sushi, #73 Celo, #76 Compound, #79 Zcash, #93 TrueUSD, #94 Yearn, #100 Curve.

II. NFTs, DAOs, and DeFi Are A Feedback Loop

My friend Linda wrote this tweet the other day:

DeFi built the foundation for NFTs to take off as it allowed assets to be exchanged without permission. NFTs enabled the growth of DAOs as there were more interesting, valuable things to govern. DAOs will lead to a major use of identity/reputation as we need to improve governance

— Linda Xie (@ljxie) October 15, 2021

I thought this was a great frame for crypto. It shows how:

- DeFi is builds the financial infrastructure for permissionless bandwidth and liquidity of value transfer

- Infrastructure which NFTs use to transfer valuable assets

- Assets which DAOs then govern in a network-native way

We can map these Web3 primitives onto Web2 as well:

- DeFi in Web3 is like routing and bandwidth logic in Web2. Throughput infrastructure for the new protocol.

- NFTs in Web3 are like JPEGs in Web2. (In fact, they are just a jpeg with a private key.) They provide us with meaning. Your grandma can send them.

- DAOs in Web3 are like wikis, forums, social media platforms in Web2. They are a network-native way to coordinate the new tech that is emerging. (Which eventually shapes the entire world, a la Facebook.)

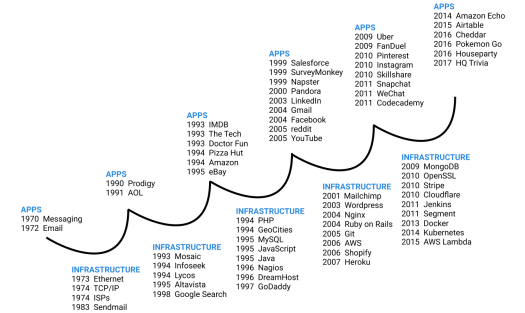

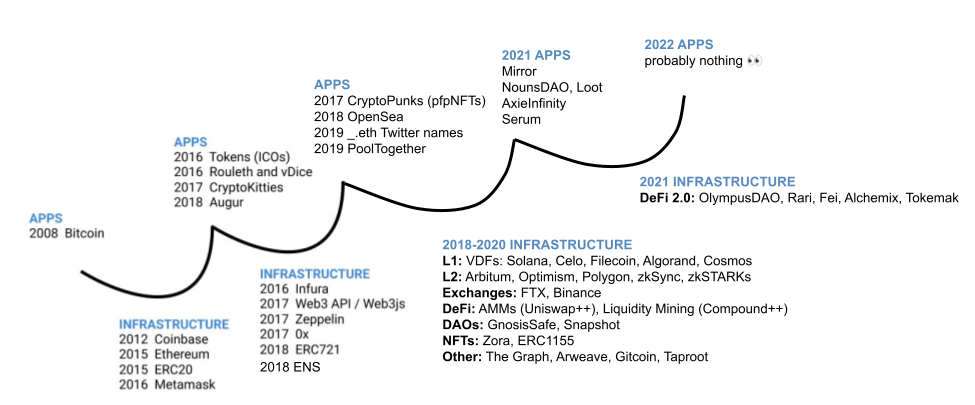

It reminds me of this 2018 piece from Nick Grossman and Dani Grant from USV, the Myth of the Infrastructure Phase. They show how internet infrastructure sets the stage for applications, which in turn forces the building of better infrastructure.

In Web2:

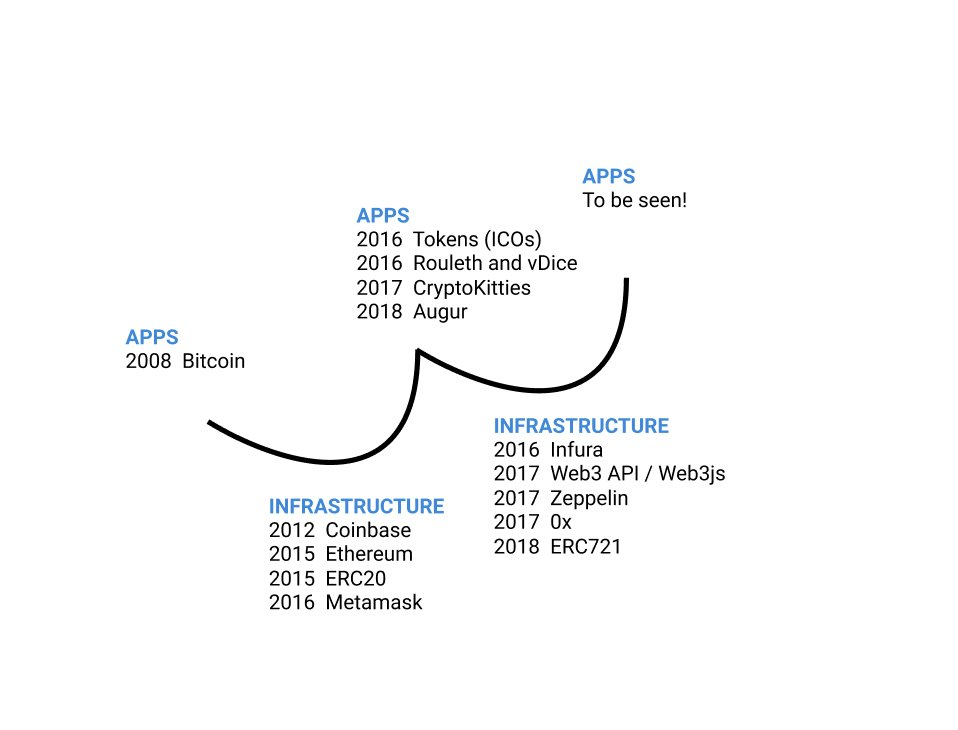

And in Web3:

Here's my update of their graph for 2021. Take a bit to check it out:

So much has happened in the last four years! ENS enabled _.eth Twitter names, ERC 721 enabled pfpNFTs, Arweave enabled Mirror, L1 VDFs like Solana enabled Serum, GnosisSafe + Snapshot enabled all kinds of DAOs.

Plus, we're just getting started with 2021 infrastructure. As a DeFi 2.0 example, Zeus from Tokemak likes to talk about how they are creating liquidity in Web3, which is similar to bandwidth in Web2. This infrastructural liquidity will then allow all of the DAO and NFT apps to actually smoothly provide good UX.

The key idea is that NFTs, DAOs, DeFi (and BTC, ETH, GameFi, L1's, L2's, etc.) are mutually reinforcing.

This all reminds me of a Richard Dawkins line from his 1970 book, The Selfish Gene. He explains the kinds of genes that win:

Selection favors those genes which succeed in the presence of other genes which in turn succeed in the presence of them.

This is what's happening today in crypto. But it's memes that survive in the presence of other memes that also survive in the presence of them.

What though powers those memes? How do they survive?

III. Crypto Is A "Nuclear Reactor" For Money and Memes

We're going to need to go a bit further back in history for this section.

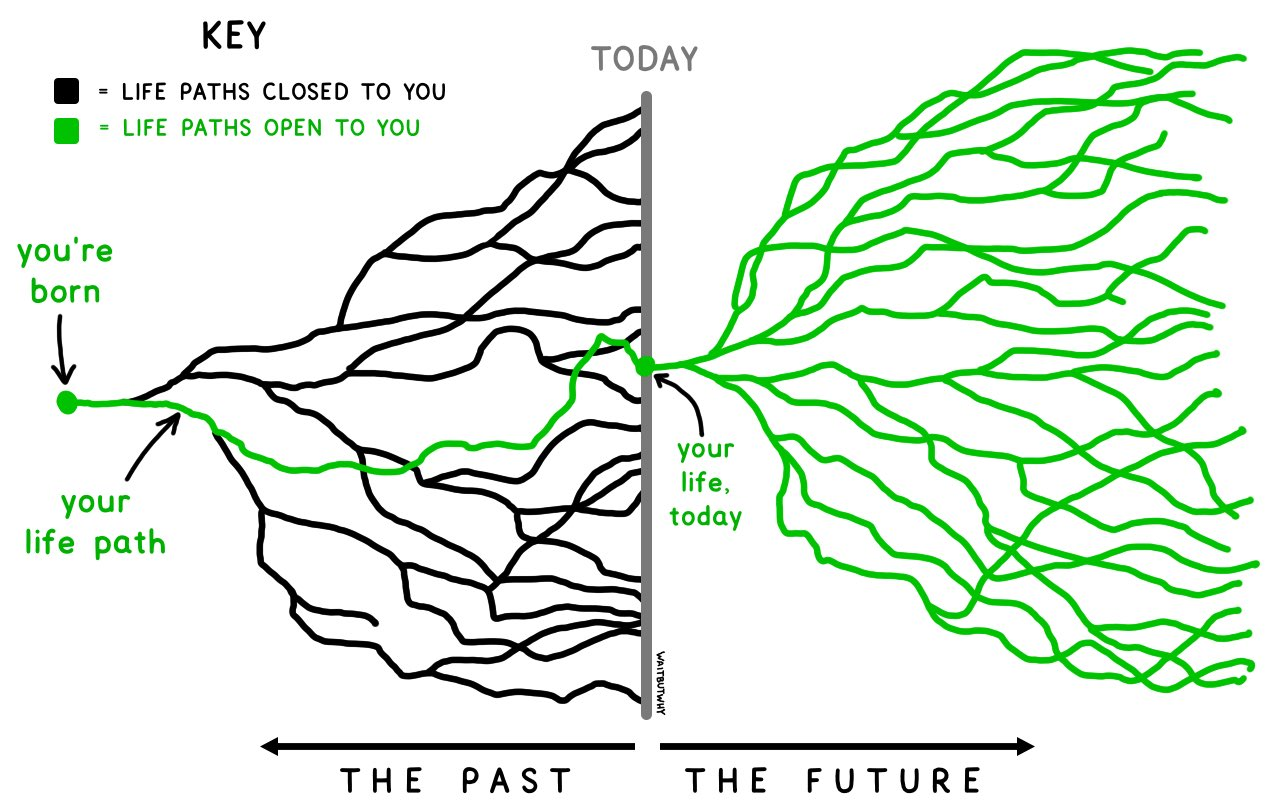

Let's start with this great Tim Urban image that shows the branching possibilities of life:

Your life has many branching possibilities from where you are now.

These branching possibilities also exist for the universe as a whole, not just your life. At different times in the universe's history, these possibilities have been shaped by different forces. At the beginning, futures were just determined by physical laws, but then by genes, and now by memes.

In other words, sure you have a lot of branches in Tim Urban's tree above. But actually, only a few of those branches are possible based on physical constraints, genetic constraints (you want to sexually reproduce), and memetic constraints (you want to spread your memes).

More specifically:

- From 14B–4B years ago, physical laws nudged the range of possible futures towards galaxies and stars.

- From 4B–200k years ago, genetic replicators shaped the range of possible futures on earth. The earth didn't just obey by physical laws of tectonic plates. Instead, it developed a full biosphere and the tree of life. By 200k years ago, the water was full of bacteria and fish, the land was full of plants and animals, and the sky was full of birds. All of which accessed energy, trickled down from the sun.

- From 200k year ago–today, memetic replicators shaped the range of possible futures on earth. Now, farms, factories, cities, and wires cover the world. There's a technosphere in addition to the biosphere and geosphere. There's a tree of ideas in addition to a tree of life.

These replicators (genes and memes) need to access energy in order to replicate. The biggest transitions all happened by them accessing new energy:

- 3B-2.5B years ago, photosynthesis allowed organisms to use solar energy. This gave off oxygen as a byproduct. Mitochondria allowed organisms to do cellular respiration with this excess oxygen. These two energetic innovations allowed organisms to move away from sea vents and cover the ocean, while also providing the energy for advanced informational upgrades like multicellularity and sexual reproduction (which led to fungi, plants, and animals).

- 550M years ago, life experienced the Cambrian Explosion. As oxygen created an ozone layer, life accessed new energy from the oxygen-rich atmosphere, and could now cover the land as it no longer had harmful UV rays.

Genetic replicators finding new access to energy.

On the memetic side:

- Homo sapiens had our first huge energy increase around 12,000 BCE as memes developed the idea of domesticating plants and animals. This led to a massive energy increase as we exploited this new frontier.

- Around 1500 CE, we had another huge increase increase from exploiting fossil fuels. By exploiting/developing the frontier of atoms, in combination with developing the science frontier, we drastically increased the energy available to humans.

- And now, we've moved from the Agricultural Age to the Industrial Age to the Information Age. We're beginning to exploit the bits frontier.

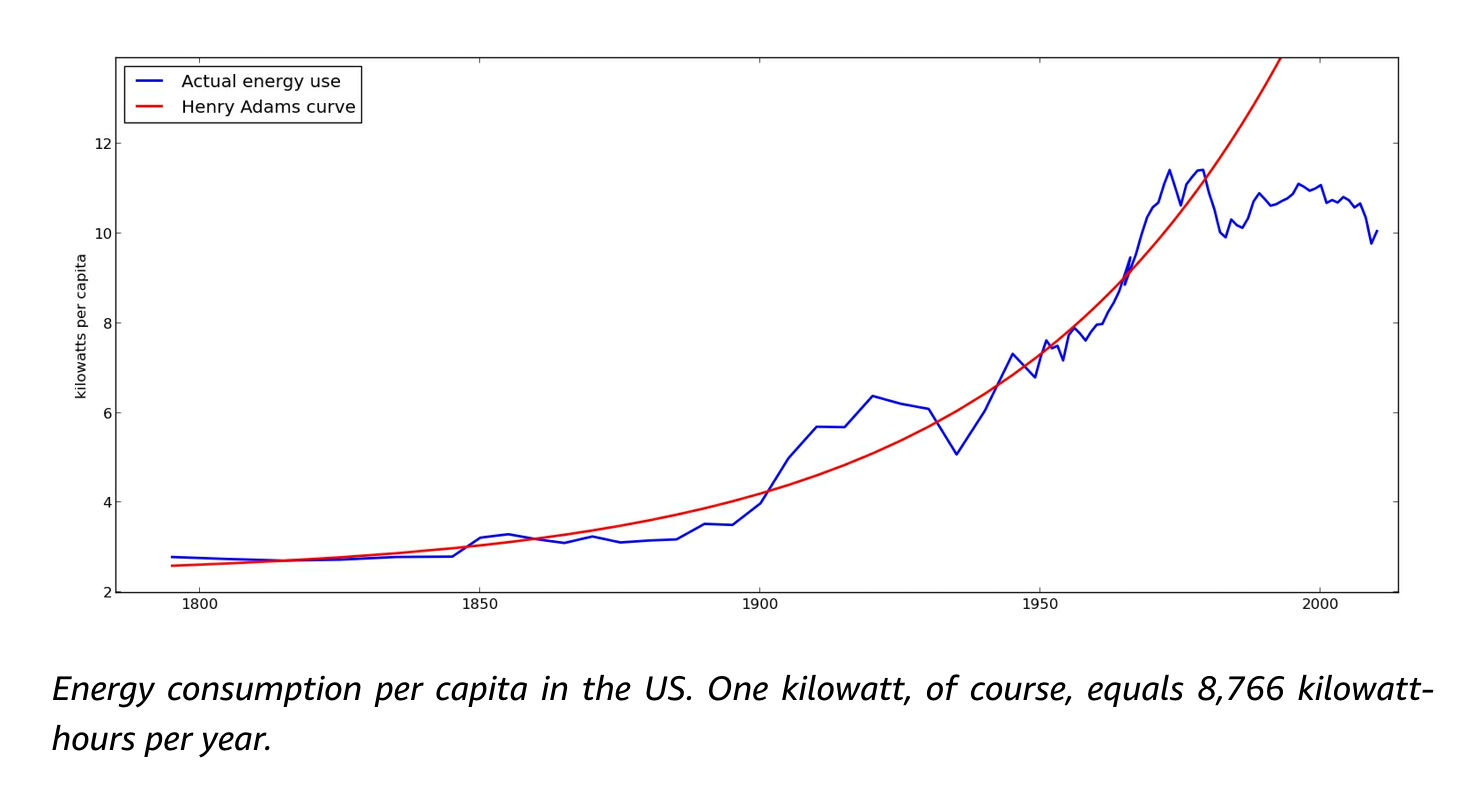

But here's a weird part of the bits frontier. It's not actually aligned with direct access to more energy. The Agricultural and Industrial Revolutions were all about energy. But the Information Age is about information technology, not energy technology. The graph below shows how we haven't increased per capita energy in the US since 1970.

Another weird part of the Information Frontier is that it doesn't have great ways to capture value. Wikipedia provides a TON of value for humanity, but Jimmy Wales still needs to beg every holiday season. Bits are hard to monetize.

In the Web2 phase of the internet, bits and money were decoupled. So there only emerged a few good ways to make money:

- Ads: Google, Facebook

- E-commerce: Amazon (selling atoms)

- SaaS: Stripe, etc. (providing gated access to an API)

With crypto and Web3 though, we can directly monetize many of the unmonetizable memes from Web2.

There is a massive frontier of value to be captured here. NFTs that sell for $66M. $DOGE over $1B market cap.

BTC gains put into ETH pre-sale. ETH gains put into DeFi infrastructure. VCs and crypto whales pumping their money back into the ecosystem.

This is why I like to think of it as a nuclear reactor. It's tapping into a vast amount of memetic value that wasn't capture-able before. This isn't direct energy (in the joules) sense, but is valuable in the memetic sense.

Printing magic internet money is immensely powerful and cannot be stopped.

IV. So What's Going On In DeFi 2.0?

With that context, let's zoom in a bit to our original question: what is this Olympus thing?

OlympusDAO is part of a new category of protocols (along with Rari, Fei, Alchemix, and others) that we call DeFi 2.0 or ZoomerFi.

It takes a bit to grok DeFi 2.0.

One frame that I found helpful is that it's GenZ kids (Crypto Class 2018) who grew up on liquidity farming and DAOs, and are now iterating on those mechanisms.

When DeFi 1.0 was being developed, there wasn't much before it. MakerDAO CDPs were an innovative thing. But now they're just the water the GenZ kids swim in. Table stakes.

Another frame I like is from Sam from FRAX and uses Coase's Theory of the Firm. Instead of allowing the market to produce liquidity, DeFi 2.0 has DAOs produce it:

So there you have it. Definition of DeFi 2.0: Creating new boundaries between the firm/DAOs and onchain market forces..such as producing liquidity/assets within the firm and creating a novel consensus/social mechanism to deploy them into the market.

— Sam Kazemian (¤, veFXS) (@samkazemian) October 18, 2021

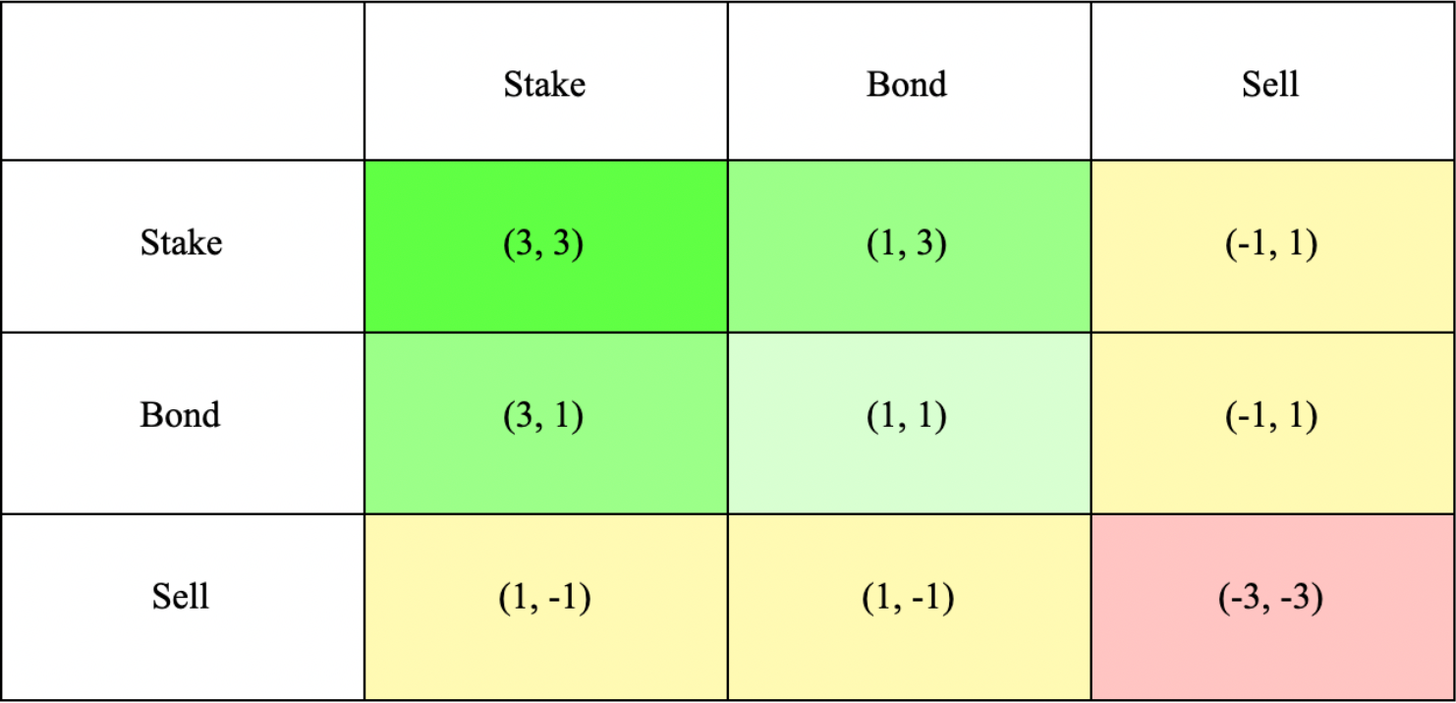

You can imagine it like this: Instead of mercenary liquidity miners allocating their liquidity to get the most yield, DeFi 2.0 DAOs own their liquidity so they can allocate it to things most aligned with the protocol.

It's like how firms allocate employee talent based on their internal needs instead of outsourcing everything to the market.

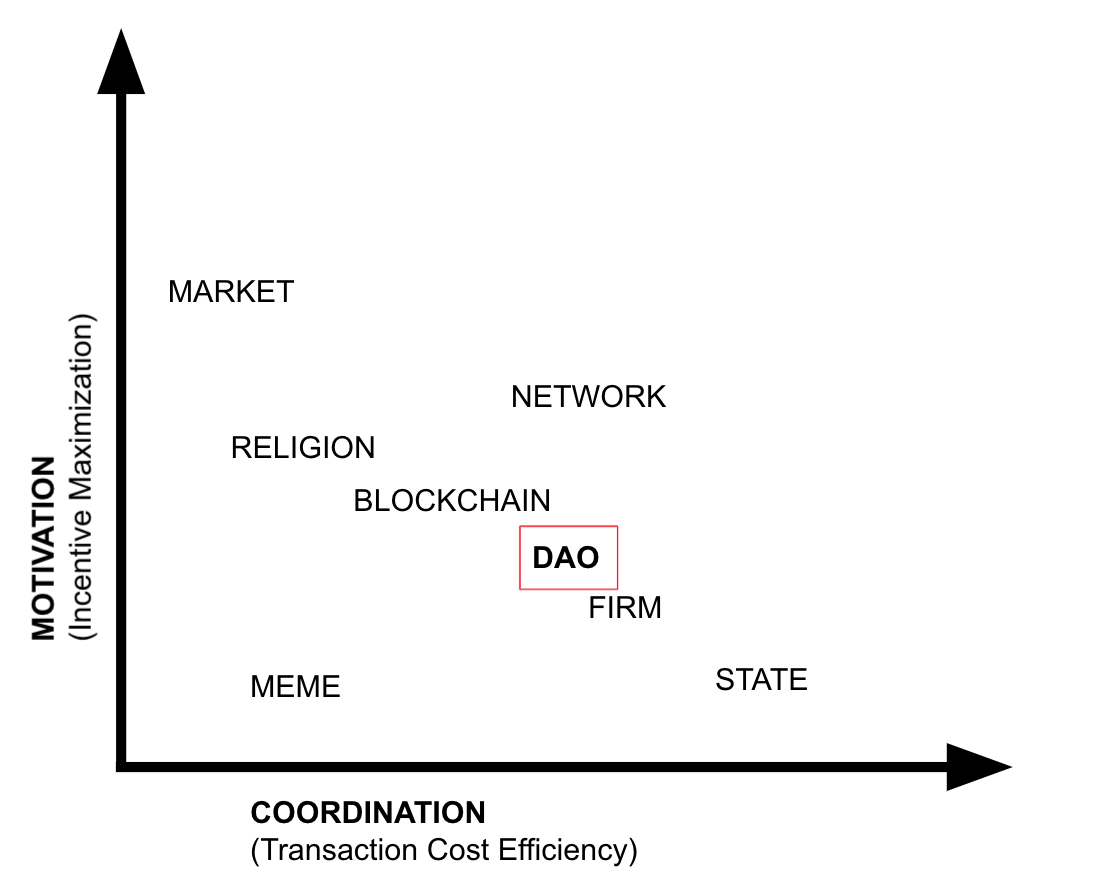

You can think of DeFi 2.0 DAOs on a more general graph of institutions. In the top left you have Markets, which are good at motivation but not coordination. In the bottom right, you have firms and states, which are good at coordination but not motivation. DAOs are now added to that list as something that can coordinate well (and allocate liquidity more efficiently).

Let's look at the specific protocols. They're all slight remixes of things that came before them.

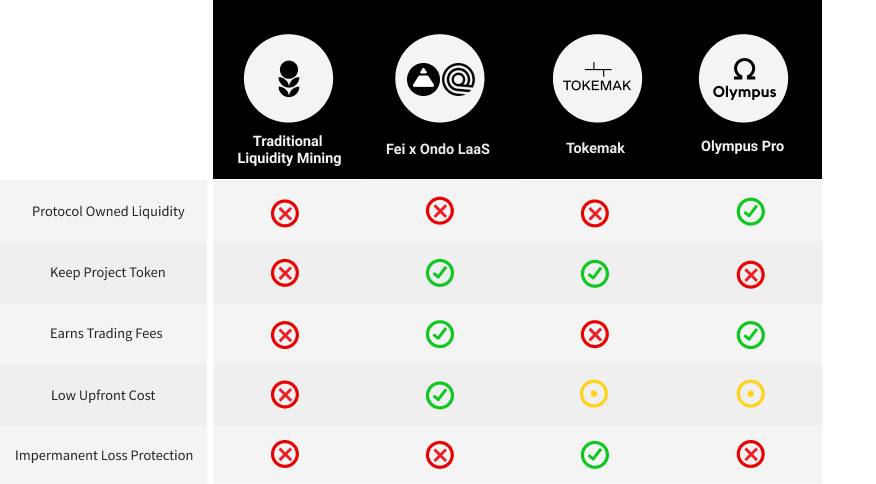

- OlympusDAO is built around the idea of Protocol-Owned Liquidity. Instead of liquidity mining, where you give your native token to liquidity providers for providing temporary liquidity, Olympus buys the liquidity outright (through a bond) in exchange for their native OHM token (so the liquidity is "protocol-owned") . It's kind of like a continuous ICO (trading OHM for tokens). It's kind of like an algorithmic stablecoin (the OlympusDAO can issue new OHM backed by its treasury). It's kind of like the Fed on-chain (both hold a pool of assets to back a currency, USD or OHM). No matter the case, OlympusDAO has been incredibly powerful at "sucking" tokens into it. It now has $2.5B locked.

- Olympus is also offering this bonding protocol for others as Olympus Pro. And there are forks of Olympus, like KlimaDAO, which accepts carbon tokens instead of DAI for their bonds.

- I won't go too deeply into it, but Fei uses a similar system, where they hold ETH to issue FEI, a stablecoin.

- Tokemak is also focused on providing an alternative to liquidity mining. They use subDAOs (which they call reactors), which accept a new XYZ token, which is then allocated across various AMMs and liquidity providers through "Liquidity Directors"—incentivized liquidity allocators. They're trying to make liquidity as abundant for Web3 as bandwidth is for Web2. They do this through the meta-protocol that allows Liquidity Directors to determine the correct allocation of liquidity across AMMs and other DEXs.

This is a beautiful graph of their differences from Joey Santoro of Fei:

- Alchemix isn't as much in the liquidity space. They're closer to something like PoolTogether. Alchemix calls it a "self-repaying loan". You give them collateral to get a loan, the interests of which is paid off by putting that collateral in yield farms. At the end, you get your collateral back. (It's "no-loss.")

- Rari is focused on lending markets, similar to Compound or Aave. But Compound has control over which markets form. With Rari Fuse, any user can create any market pair. Just like how Uniswap provided a permissionless DEX for the long-tail of assets, Rari is providing a permissionless protocol for lending.

All of these projects collaborate with each other and own each others' tokens.

Memes that are replicating in the presence of other memes.

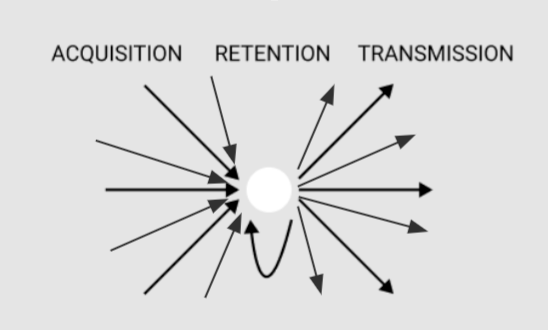

One other crucial idea from a group selection / memetic perspective: All memes (including intersubjective, code-governed myths like DAOs) want to both survive (retention) and spread (acquisition and transmission).

The DAOs spread through viral memes like (3,3), which we'll explore more below. But they also need the capital to survive. As we looked at in section II, digitally native memes and myths had trouble surviving unless they were able to access capital (e.g. GAFA monetizing the attention economy). But crypto allows memes to stick around:

Memes have conquered the transmission niche.

— Rhys Lindmark (🐘, 🐘) (@RhysLindmark) June 22, 2021

Blockchain has conquered the retention niche.

Work on a crypto-system, and your work may last lifetimes.

— Naval (@naval) September 20, 2021

Work on a walled garden, and your work will land in the dustbin of history.

As Zeus notes below, protocol-owned liquidity allows DAOs to survive for much longer. If a DAO doesn't have a deep bank account, it might die during a bear market. But with "Proof-of-Reserves", it can stick around:

10/20 - This is huge for two reasons:

— Zeus Ω (3, 3) (@ohmzeus) April 4, 2021

1) Longevity: A protocol that owns its own assets can go dormant but can never die

2) Efficiency: The more the protocol owns, the less it relies on third-party actors, and the less it needs to pay third-party actors

Ok! I want to highlight a couple of additional things about DeFi 2.0:

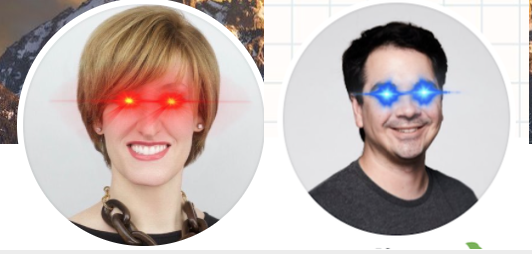

1. Many of the community leaders are pseudonymous.

Here are the leads for OlympusDAO:

Here's the leader of Alchemix:

And the KLIMA DAO team (Dionysus, Archimedes, and Oxylos):

This allows these communities to conduct more risky financial activity (OlympusDAO bonding is roughly the same as a continuous ICO) with less fear of the state.

More anons, less business.

How it started: How it's going: pic.twitter.com/b8XbaP3cli

— Rhys Lindmark 🐘 (@RhysLindmark) September 22, 2021

2. DeFi 2.0 LARPs with NFTs For Meaning

DeFi...

...is money

...is something that meets basic needs

...is a means to an end.

So DeFi financial gains needs to be converted to meaning. This often comes through NFT LARPing. For example:

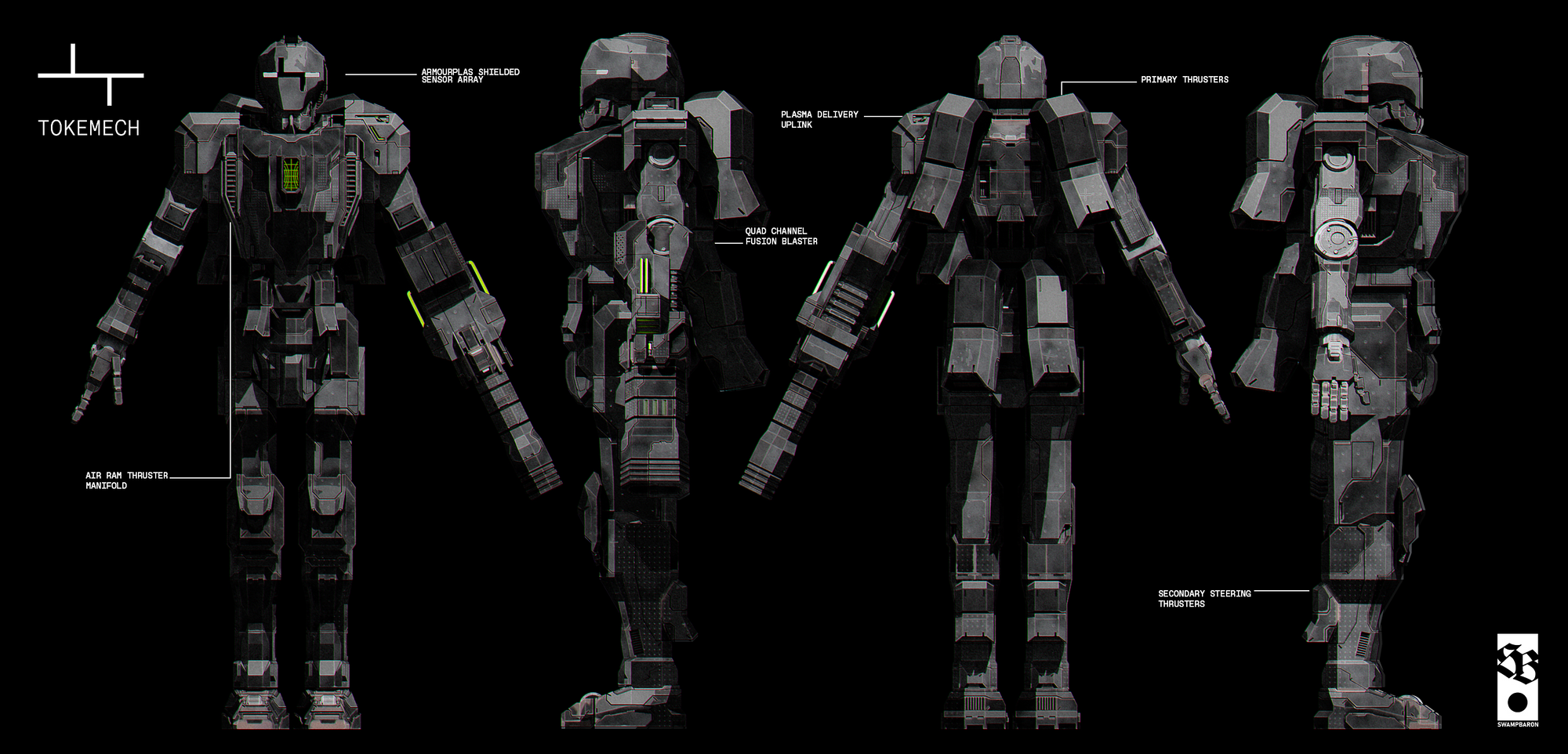

In development: an NFT project which will celebrate our community culture, set in a rich Space Opera metaverse.

— TOKEMAK (☢️,☢️) (@TokenReactor) October 11, 2021

The Tokemak Pilot NFTs bring our discord bar, the Leaky Reactor, to life + will allow holders to build playable Tokemechs. All will map back to the Tokemak economy ☢️ pic.twitter.com/MIkcVr9yqc

Or this pic, a remix of pmarca's "It's Time To Build" picture:

(DeFi, 2.0) pic.twitter.com/fvA34JGLMN

— OlympusDAO 🕊 (@OlympusDAO) October 12, 2021

The members of the Tokemak community are called Tokemechs:

As shown in II, NFTs provide the meaning for financial infrastructure.

3. DeFi 2.0 (and 2021 Crypto) Comes With A New Set Of Memes To Signal The In-Group

In 2017, the hip memes were #DeFi itself, #BUIDL, and others. Now, we have a full new set of memes:

OHMies from OlympusDAO signal that they are choosing to stake in their OlympusDAO cryptoeconomic game by adding (3, 3) to their profile:

(3,3)

— Grimes 🪐 ᚷᚱᛁᛗᛖᛋ (@Grimezsz) October 17, 2021

Memes like to be remixed to things close to them (BLM --> AllLivesMatter), because then they rise and fall together. Like a Burger King setting up shop near a McDonalds.

So the (3,3) meme has been remixed by folks like Tokemak (☢️,☢️) and KlimaDAO (🌳,🌳).

HODL from the past has turned into wagmi (we are gonna make it) and ngmi (not gonna make it). These again signal in-group and out-group dynamics.

In 2017: are you a shitcoin, a pump and dumper, or are you a HODLer with us?

In 2021: outsiders ngmi. Insiders, wagmi.

Wagmi is a lifestyle

— Zeus Ω (3, 3) (@ohmzeus) October 20, 2021

Gm

The other interesting part of wagmi is that it's collaborative by nature, like #SquadWealth.

Memes that survive in the presence of other memes that also survive in the presence of them.

[Update: Packy McCormick did an awesome expansion on the wagmi meme and sc3nius here.]

"gm" (good morning) is another new meme (also, gn). It's powerful because it happens every day, so has natural survivability. Kind of similar to praying five times a day or weekly mass.

"iykyk" (if you know, you know) is another powerful meme. This is memetically fit because it's FOMO-inducing. You want to learn about the thing that you don't know about. iykyk has spread outside of crypto as well.

Iykykhttps://t.co/9smH40Snqj pic.twitter.com/Jc9zgoOkJz

— Dan Elitzer 🌱 (@delitzer) September 18, 2021

Also in the memetic/language space: When the DeFi 2.0 projects denote their tokens, they are increasingly required to use four characters ($ALCX vs. $BTC) and/or use a two-letter prefix ($alETH vs. $cETH). All of the three-letter $COINS are taken.

Finally, we've seen an amazing spread of memes that live at the profile level.

Folks in the ETH community use ENS names like vitalik.eth as your Twitter profile name. Folks replace B with ₿, E with Ξ, and O with ◎.

Profile pictures themselves have changed. Red (BTC) and blue (ETH) laser eyes are one form of this.

This spread to Profile Picture NFTs or pfpNFTs. This is where you buy a humanoid NFT (like a CryptoPunk) that is then used as your Twitter profile picture.

DeFi 2.0 projects use both cryptoeconomic innovation (like protocol-owned liquidity) and memetic innovation (like pfpNFTs for meaning) to create powerful communities.

Zooming out from memes specifically: I'm pretty bullish on DeFi 2.0.

Though the UX is still bad (I had to spend $100 in gas fees, use Uniswap, etc.), I expect these experiments in routing liquidity to continue to gain capital and spread.

V. Other Progress

Looking from 2017 perspective (and placing DeFi 2.0 in context), there's a lot of other things happening in crypto:

1. Many of The "ETH Killer" L1 Chains Have Launched

Solana, Celo, and many other L1's have found new niches in the smart contract protocol landscape. And they're just getting started. Solana just organized their first IRL crypto event!

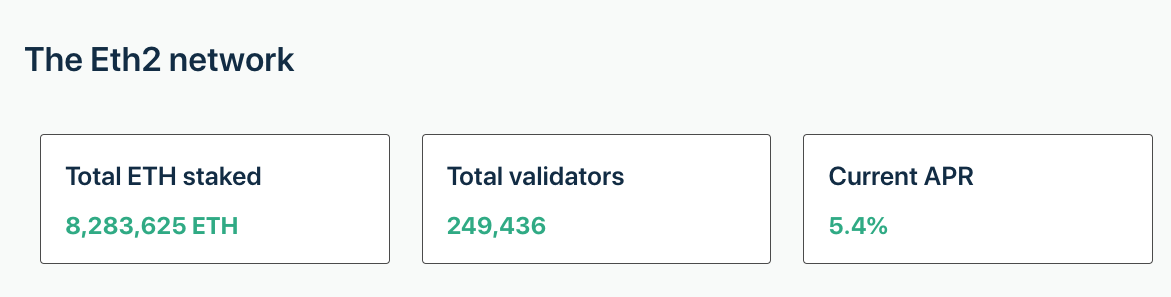

Meanwhile, ETH 2.0 has launched staking on their beacon chain and will merge the mainnet with this beacon chain in 2022.

2. L2's Work And Are Awesome

Polygon, Loopring, Zksync, Optimism, and Arbitrum all exist and are integrated in with large platforms. I mint my OpenSea NFTs with Polygon. Folks like dYdX use StarkWare to drastically increase their tx/second.

3. GameFi Has Taken Off

WoW miners and other workers in early 2000s digital games were earning $300M before eBay shut them down in 2005.

The new Play-To-Earn game movement has reinvigorated this space. I like the frame:

DeFi is gamifying finance, GameFi is financializing games.

- Someone from Axie Infinity or YGG i honestly forget

4. Decentralized Web Advocates Are Joining Crypto

This has mostly happened at Filecoin Foundation recently. It's great to see.

Sarah Drinkwater (previously head of Responsible Tech at Omidyar) is now a Senior Advisor at Filecoin Foundation.

Marta Belcher is now the Board of the Filecoin Foundation.

Danny O'Brien (of EFF) is also a Senior Fellow at Filecoin.

News! I’ve joined the Filecoin Foundation @filfoundation, and Filecoin Foundation for the Decentralized Web @ffdweb! I’ll be helping technologists, archivists and teachers building the #dweb. We aim to restore the net’s superpower: distributing knowledge and autonomy to all. 1/19

— Danny O'Brien🤖 (@mala) July 20, 2021

Plus, folks like Tomicah Tillerman have left New America for a16z.

5. Crypto Billionaires Have Been Funding Good Stuff

Astera Institute is a new nonprofit focused on influential work with metascience and FROs. They're funded by Jed McCaleb of Stellar.

SBF is the world's richest ever person at age 30 (beating Zuck) and has funneled money towards effective altruist causes.

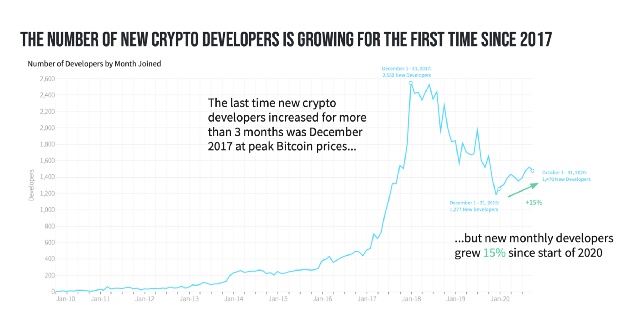

6. The number of new crypto developers is growing for the first time since 2017

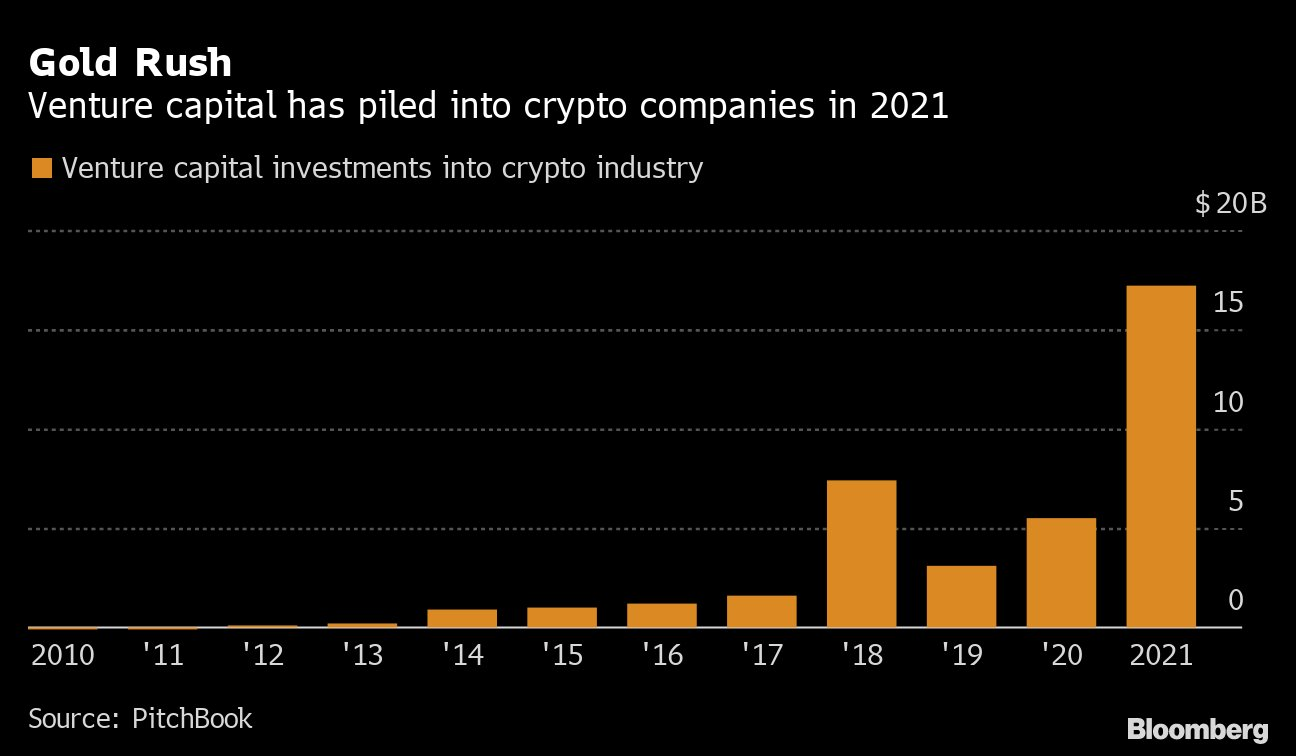

7. So Much VC Money

In 2017, there weren't that many good places to get VC money. Metastable started in 2014, DCG in 2015, and Polychain in 2016. Now though, there are tons and tons of great places to get money.

Existing VCs like a16z have started crypto-specific funds (starting in 2018). And all the folks that used to work at big firms have their own shops. Random ones top-of-mind:

- Soona Amhaz: Volt Capital $10M (2020)

- Linda Xie: Scalar Capital $20M (2018)

- Fred Ehrsam, Matt Huang: Paradigm $300M (2018)

- Ash Egan: Acrylic $55M (2021)

- Jesse Walden, Li Jin, Spencer Noon: Variant $110M (2021)

- Dan Elitzer: NascentXYZ

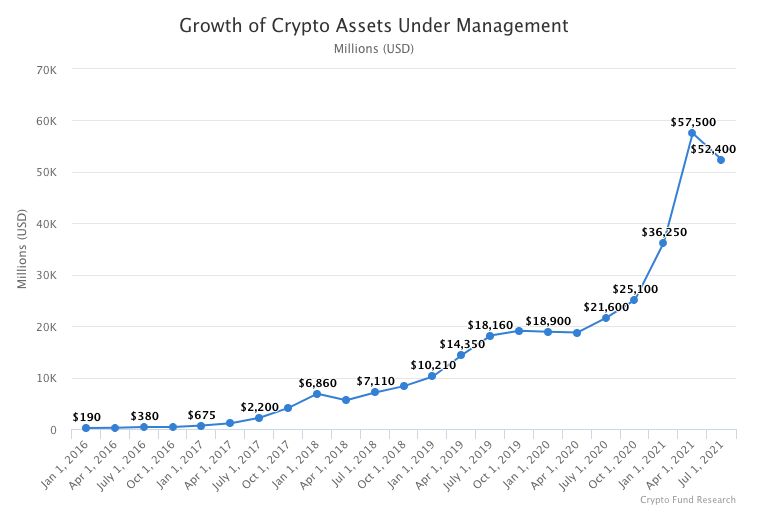

Here's the total AUM of crypto VCs and hedge funds:

And the amount of VC money put into crypto in 2021:

8. We're developing memes to describe new economies:

It’s curious that appending the word “economy” another word to make a phrase, as in “experience economy,” lsharing economy,” and “passion economy” is largely a rhetorical device used a to signal the phrase-coiner’s interest in financial gain and indicate an investable category

— Toby (@tobyshorin) September 24, 2020

And we now have the Passion Economy and the Ownership Economy (both of which I'm v into!).

Plus other shared words like #DeFi, #GameFi, #DeSci, etc.

9. Blah blah blah, Stripe, institutional money, inflation, Taproot, The Graph, Mirror, etc.

Disclaimer:

In 2017, I was v into all of this but (for stupid ethical reasons) didn't buy $10 ETH or $MKR or anything.

But I think DeFi 2.0 is great! So I've decided to increase my exposure to it.

Here's my Etherscan: https://etherscan.io/address/0xFf9387A9aaE1F5DAAB1Cd8Eb0E92113eA9d19CA3.

In the process of writing this, I have roughly $2,000 of FXS, TRIBE, OHM, ALCX, and TOKE, all of which is staked. I also bought $500 of RARI. I have GRT, SOL, BTC, and ETH as well.

Other Reading:

- Scoopy on DeFi 2.0:

Over the course of 2022, we have seen the rise of what has been called "DeFi 2.0".

— goldman scoopy sachles 2.0 (@scupytrooples) October 11, 2021

As a farmer, degen, student, and builder in DeFi, the vision of the future of DeFi is beginning to materialize in my mind's eye.

🥁

THREAD TIME

- Good overview on why risk-free value and why Olympus might not be a bad ponzi game, from Nat Eliason: I Was Wrong About Olympus

- Great frame on NFTs from Jordan Greenhall: A Novel Perspective on NFTs

- Dan Elitzer on how permissionless lending helps DAOs:

Are you hyped about @RariCapital's Fuse permissionless lending pools yet?

— Dan Elitzer 🌱 (@delitzer) October 16, 2021

What if I told you they are going to be an absolute godsend for DAOs with treasuries, and especially for communities like @FWBtweets and @BanklessHQ?

Let's unpack a DAO Treasury Fuse Pool Template 👇

- Another frame on OlympusDAO:

Proof of Work Mining vs. Proof of Reserve Bonding

— Zeus Ω (3, 3) (@ohmzeus) June 13, 2021

Similar inputs, different outputs

A thread 👇👇👇👇👇👇👇👇👇 pic.twitter.com/NI8af1qaza

ESD regulates supply via debt (liabilities) while OHM regulates supply via equity (assets).

Other Videos:

Bankless has a bunch of great video interviews with DeFi 2.0 leaders: